MARKET PERFORMANCE

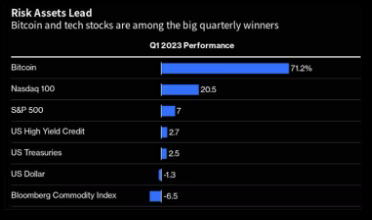

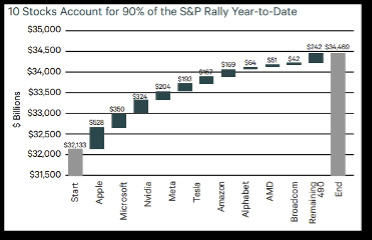

After a year of historic double-digit losses in both equities and fixed income in 2022, stocks and bonds delivered positive returns in the first quarter of 2023. The S&P 500 Index returned 7.50% and the Bloomberg U.S. Aggregate Bond Index returned 2.96%, a solid start for both benchmarks. Growth stocks, led primarily by mega-cap technology stocks, dramatically outperformed value stocks as evidenced by the Russell 1000 Growth Index increasing 14.37% versus the Russell 1000 Value Index return of 1.01%. The highest contributors to equity returns in the S&P 500 Index in the first quarter included mega-cap technology companies such as Apple, Microsoft, NVIDIA, Tesla, and Meta.

Source: Bloomberg

Source: Strategas

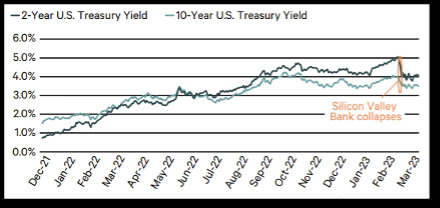

High yield, as measured by the ICE BofA U.S. High Yield Index, outperformed the Bloomberg U.S. Aggregate Bond Index appreciating 3.72% versus 2.96%, respectively. Municipal bonds slightly lagged the broad fixed income market returning 2.78%, as measured by the Bloomberg U.S. Municipal Bond Index. Most of the decline in interest rates occurred during the surprising bankruptcy of Silicon Valley Bank late in the quarter.

Source: Koyfin

FIRST QUARTER CROSS CURRENTS

We came into 2023 with clear consensus among investors that the year would bring at least a mild recession. January data was stronger than expected and the market quickly priced in a “no landing” scenario. February data was somewhat weaker, and the market started to price in a “soft landing” outcome. Then a regional bank crisis emerged, and the market started to price in a “hard landing” scenario. Fortunately, banking fears started to dissipate the last two weeks of the quarter. Multiple cross currents in interest rates, inflation, economic growth, and investor sentiment have made for a difficult forecasting environment for investors. While the short-term outlook is somewhat murky, we believe that the long-term outlook should be attractive. Cash is piling up on the sidelines, investors are generally negative, speculation is absent from equities (IPOs, SPACs, and memes are dormant), and businesses are very cautious in hiring and expansion plans. Historically, these types of conditions have led to meaningful long-term investing outcomes, although it will remain to be seen how markets will respond for the remainder of 2023.

ANOTHER BANKING CRISIS?

Silicon Valley Bank was the latest casualty in the long history of the Federal Reserve “raising rates until something breaks.” The speed and magnitude of the bankruptcy was unprecedented. Throughout history an inverted yield curve creates problems for a banking business model that relies on borrowing short term and lending long term. Increased borrowing costs combined with a declining loan portfolio can quickly create a crisis for financial institutions. Examples include the Savings and Loan Crisis in 1990 and the Great Financial Crisis of 2008. From our perspective, this banking crisis seems non-systemic and more isolated to the specific fundamentals of Silicon Valley Bank and Signature Bank, but we will continue to monitor for any further signs of banking deterioration. It certainly has had a potential tightening effect on the economy and has made interest rate policy more difficult to forecast for the Federal Reserve. The significant decline in market yields has occurred due to the pressure on many small and medium-sized lending institutions and we believe this has increased the likelihood that the Fed is close to or done raising interest rates.

WHAT SHOULD AN INVESTOR DO NOW?

Perceived safe havens and quality stocks performed well in the first quarter as investors have continued to grapple with high uncertainty in the market outlook. As you know, our investment philosophy focuses on quality companies with a sustainable competitive advantage. It is unclear how long these cross currents will last or if the Fed is already close to or done raising interest rates. Either way, we will continue to seek out businesses that can perform in good and bad times for our clients. Thank you for your trust and support in this uncertain short-term environment.

Investment advisory services offered through Channel Wealth, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third party sources and is believed to be reliable.