Hello and welcome to our review of 2022 and outlook for 2023. Thank you for reading.

Last year was historically bad for markets, with the very rare event of coinciding negative returns for both stocks and bonds happening for the third time in recorded history. In addition to that, the bond market produced its worst calendar year since 1928. To begin our outlook, we offer our general conclusion: There is uncertainty with respect to markets and the economy. Corporate earnings are in question due to inflation and consumer spending pressures. Inflation remains a central theme, but it appears to have peaked, and the question is ‘how quickly will it return to a more palatable level?’ If employment remains stable, we believe there is a good chance that the economy will have a soft(ish) landing and markets should be resilient. If unemployment rises sharply, it may lead to a deeper recession. To be clear, the later scenario is not our base case at this time.

There is one important aspect that we believe is healthy to remember; the stock market is a forward-looking pricing machine. Much of the news that comes out today or tomorrow should be already priced into markets, which are looking across the bad news trough and to the other side where ‘recovery’ is happening. As we begin 2023, we maintain a cautious but constructive outlook on investments and markets even though there is much to be worried about from many perspectives.

Let’s start by looking backwards to arrive at our conclusion.

In just the past three years, the global economy has endured a global pandemic, the return of inflation, and a ground war in the heart of Europe. Geopolitically and economically the great power rivalry between the U.S. and China has intensified. Technologically, the disruptive effects of artificial intelligence, the rapid adoption of robotics and the digitalization of virtually everything has contributed to a complex web of considerations for investors.

Review

Multiple headwinds overwhelmed the economy and markets over 2022, generating disappointing returns for most asset classes. Inflation seemed to be the dominating headline during the year, spurring the Fed to raise interest rates faster than markets anticipated. This created a very difficult market for both bonds and stocks. As interest rates increased, not only were bonds devalued, but it also changed the way stocks were valued.

The S&P 500 lost nearly a fifth of its value over the year (or -19%), its worst annual return dating back to the Great Financial Crisis and well below its 10-year average annualized returns of over 10%. Since inception, the benchmark index has ended in positive territory 73% of the time making last year’s decline somewhat of a rarity. It rarely ends that badly, with only 13 instances of a -10% (or worse) decline dating back to 1928. More the rule and less the exception, many stocks (over 350) within the S&P 500 ended in the red, and nearly 30 of the worst performers shed more than 50%.

For bonds, interest rates rose dramatically in 2022 lifted by the precipitous rise in inflation and the Fed’s forceful campaign of rate increases. The yield on the ten-year U.S. Treasury note rose from 1.51% in January to 3.88% at year-end, touching a fourteen-year high of 4.34% in October. Most fixed income portfolios were hard hit by rising yields, with the Bloomberg U.S. Government / Credit Bond Index registering a -13.5% return for the year and many fixed income benchmarks suffering record declines.

The combination of stocks being negative while bonds are negative is something that has only happened two other times in history. Each of those instances were during periods of historical market stress during the great recession and during inflation in the 70’s. In each of those times the bond market was down marginally.

While it is a difficult market to have endured, it offers some opportunities which we would like to highlight.

Outlook

This is how we believe 2023 will differ from 2022:

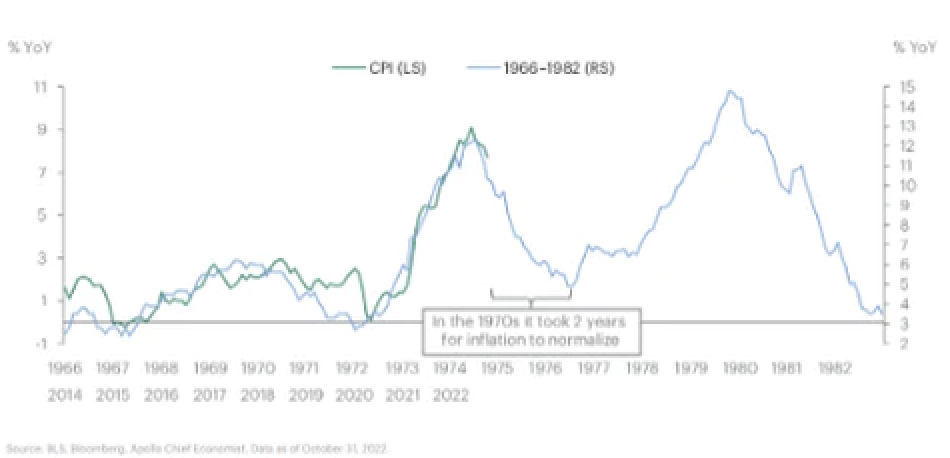

US inflation appears to have peaked in June 2022. The decline in inflation in recent months has been driven by the goods sector, while prices of services have proven stickier. Real estate has also declined for 5 straight months on a national level. Although the downtrend in inflation is positive news for markets, we may not be to get back to the 2% annual inflation target anytime soon. In fact, history shows it could take up to two years for us to get there.

It appears that supply chain driven challenges have abated and increases in interest rates have begun to affect consumer behavior, and prices are coming down in parts of the market.

So far, the decline in inflation seems to be taking place without a sharp increase in the unemployment rate, which points to a higher probability that the Fed might engineer a soft landing for the US economy. This is a scenario that many thought very unlikely just a few months ago and is probably responsible for the favorable start to the year for the stock market. The sequencing of how the Fed reaches its dual mandate (taming inflation and maintaining full employment) is key for capital markets. Receding inflation first, moderating employment later should mean that the need for “demand destruction” on the part of the Fed decreases.

Rates: A potential Fed “pivot” in 2023—when the fed stops raising rates, or even lowers interest rates-should be bullish for markets but volatility will likely persist because capital remains scarce and expensive.

Dollar: A key factor to watch is where the US dollar goes from here. In 2022, the strong dollar seemed to be a wrecking ball for other economies, both in the developed world and for emerging countries who borrow primarily in US dollars. If the Fed continues to raise rates, an even stronger dollar could accelerate the onset of recession in other markets & economies. Conversely, if the dollar declines relative to other currencies around the world it could bring broad relief and increase overall liquidity across challenged economies.

China: One of the most significant macro events of 2023 is the abrupt reopening of China after a three-year coronavirus shutdown. China’s growth prospects have been rapidly upgraded for 2023.

Fixed Income: Bonds are back! U.S. bond market have never posted three consecutive years of negative returns. We believe bond yields are attractive today, and as interest rates peak this will act as tailwind for returns – one we have already begun positioning for within our current guidance.

Europe’s (and the US’) Ground War: As the year begins, the conflict grinds on and continues to affect asset prices in the U.S. and abroad.

Investment Implications

In general, we favor fixed income/bonds in the first half of 2023 and remain in a more defensive equity positioning. Portfolios are benefited by higher interest rates because bonds now have attractive income yields.,

This is the single most important consideration going into 2023; bonds now have a different role in investors’ portfolios than they have had over the last 14 years. They can provide a reasonable rate of return with lower risk than stocks. They also have the potential to offer a counterbalance to equities if markets have a decline. That is the traditional role they have played, but because interest rates were so low over the past decade, their ability to serve that function was diminished. With rates returning to levels not seen in over a decade, bonds are both viable and important again.

For equities, we favor quality businesses that are highly profitable, with stable earnings, low leverage, and whom are leaders in growing industries. We continue to believe that market volatility will be elevated for most asset classes and expect the “grind-it-out” environment to persist for markets over the next several months before stabilizing later in 2023. With so many factors in play, and many of these pointing to increased downside risk, we maintain a cautious outlook in preparation for the next 12 months of uncertainty, whilst always being mindful that markets are forward-looking and sentiment will rise before the data shows the economy to be on an improving track.

It is important to remember that the stock market is a six-month forward-looking mechanism and tends to anticipate recovery in economic data before we have a chance to see the data. Remaining invested throughout market cycles is the only way to reap the returns that markets have to offer.

Investment advisory services offered through Channel Wealth, LLC], a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third party sources and is believed to be reliable.