Mid-Year Market Review—Better than feared, and the “Magnificent Seven”

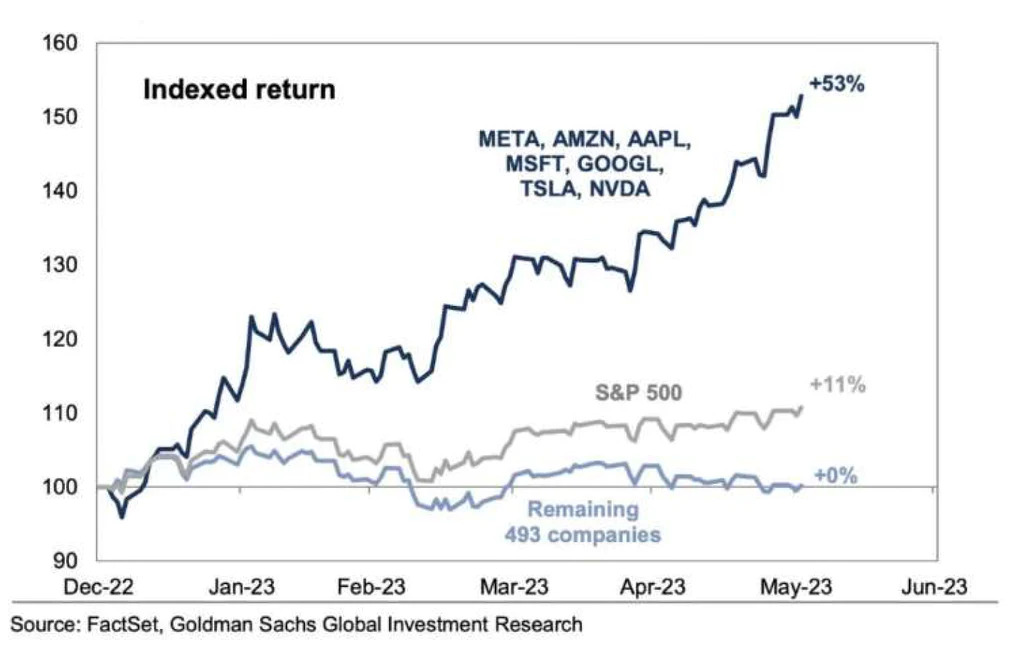

Stocks have climbed a formidable wall of worry as the collateral damage from banking turmoil was not as severe as feared. The first half of 2023 turned out to be a good period for investors: global equities have returned about 17%i. “AI” has become a household name, and “AI” related companies like NVIDIA have lifted the markets single handedly. The “magnificent seven” is the latest term to be given to the small number of stocks driving the surge in this year’s stock markets. This list includes Apple, Microsoft, Amazon, Meta, NVIDIA, Tesla, and Alphabet. Bond yields have remained quite stable since early 2023, thereby creating positive nominal returns for investors. The U.S. economy continues to show resilient growth as upturns in both residential construction and in robust consumer travel have been notable positives. Although stronger growth has meant sticker inflation, we continue to see progress on inflation decelerating.

Market Outlook—Resilience, Diversification & Diamonds in the Rough

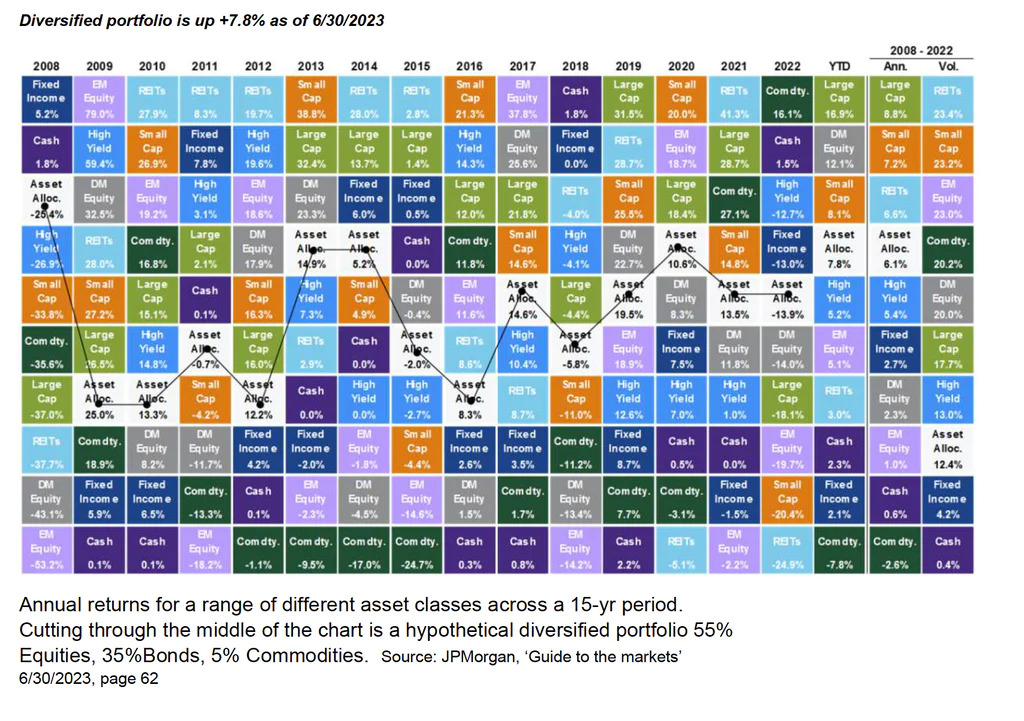

At this point in time, we are in the camp that the US economy will continue to show a healthy degree of resilience. The second half investment returns may not be as punchy as the first half, but we expect the S&P 500 to remain positive through the end of the year. The S&P 500 positive returns were driven by a small number of technology companies. We believe that there will be a broadening out of the market. We see opportunity in the industrial sector, REITs, technology, and smaller to mid- size companies. We continue to view the bond market constructively, with great opportunities to lock in attractive yields and total return.

Where’s the Recession we were promised?

The 2023 recession that economist predicted is missing in action. Now the forecasters are suggesting that a soft landing is probable. There are a few factors at work that include demographic changes that impact employment, and interest rate de-sensitivity in the housing market.

MID-YEAR REVIEW

BETTER THAN FEARED

Despite turmoil, stocks enjoyed positive returns across the spectrum. Regional banks failing, debt limit jeopardy, and interest rate hikes are a few of the issues that the market has taken in stride. U.S. equities climbed in the second quarter with the S&P 500 advancing a solid 8.74%, bringing the first half of the year return up to 16.89%.

Large-capitalization growth stocks, as measured by the Russell 1000 Growth Index, have been the best performers by far, advancing 12.81% for the quarter and 29.02% for the year-to-date. Market breadth continued to be mediocre with the Russell 1000 Value Index up 4.07% for the quarter and 5.12% through June 30.

Small-capitalization stocks continue to lag the S&P 500, as measured by the Russell 2000 Index, advanced 5.21% in the quarter and 8.09%i year to-date. International equities, as measured by the MSCI EAFE Index, only advanced 2.95% in the quarter but they have returned 11.67% year-to-date with Japan remaining a bright spot as its economy continues to recover from pandemic restrictions. The MSCI Emerging Markets Index was a laggard advancing 0.90% for the quarter and 4.89% for the year-to-date.

During the quarter, the 10-year U.S. Treasury yield rose slightly from 3.49% to 3.81%. This resulted in the U.S. Aggregate Bond Index declining -0.84% for the quarter, although it is still positive year-to-date returning 2.09%. High-yield bonds, as measured by the ICE BofA U.S. High Yield Index, fared better advancing 1.63% for the quarter, bringing the year-to-date return to 5.42%. Municipal bonds, as measured by the Bloomberg U.S. Municipal Bond Index, were down slightly for the quarter declining -0.10%, but positive year-to-date returning 2.67%.

Investment Implications

We remain cautiously optimistic about broadly embracing risk assets while equity market performance is led by a narrow segment of companies amid a protracted Fed tightening campaign. The probability of a recession in 2023 has significantly decreased.

FORGET FAANG, MEET THE ‘MAGNIFICENT SEVEN’

Last decade the acronym ‘FAANG’ was popularized as it represented the strongest tech stocks at the time, many of which continue to outperform to this day. The “magnificent seven” is the latest term to be given to the small number of stocks driving the surge in this year’s stock markets. This list includes Apple, Microsoft, Amazon, Meta, NVIDIA, Tesla, and Alphabet. These companies were hit hard in last year’s bear market and had been cost cutting late last year to right-size their businesses. In addition, these stocks have been driven by the Artificial Intelligence boom. The combined value of these seven stocks is $11 trillion –nearly triple Germany’s GDPii. The other 493 stocks of the S&P 500 and smaller companies have been relative laggards since the market bottomed out last October. We have seen some improvement in breadth over the last half of Q2, but not robust enough to call it a trend. If breadth expands, this would be a positive sign for the overall stock market and health of the economy.

MARKET OUTLOOK – EQUITIES

Resilience, Diversification & Diamonds in the Rough.

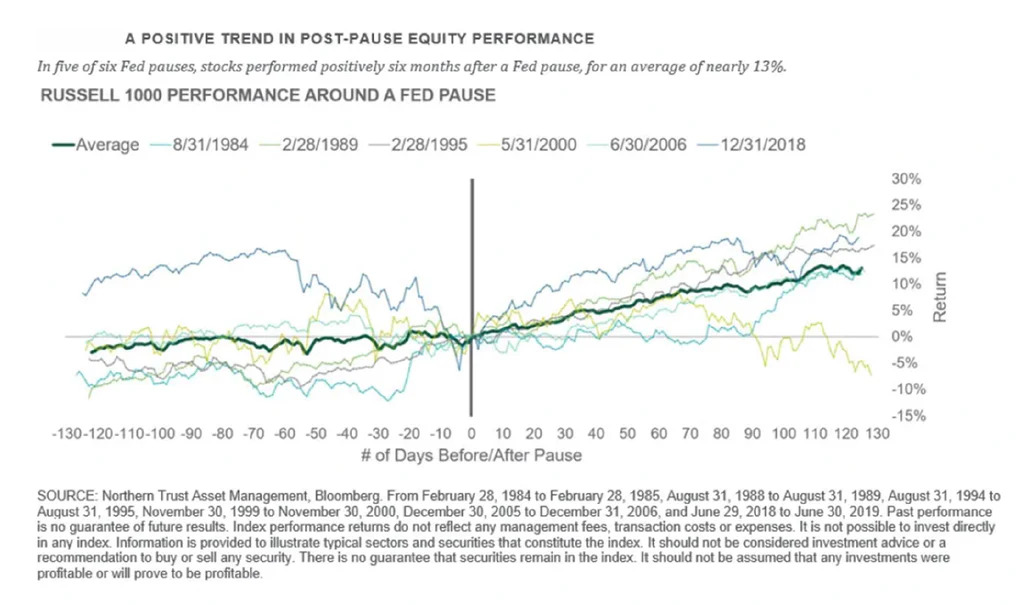

We believe the S&P 500 should stay positive for the rest of the year, albeit with more volatility than the first half of 2023. Historically the market has seen solid returns during a Fed interest rate “pause”. In addition, the odds have improved that the economy will hold up through the end of the year. This could imply that there will be broader participation by companies besides the big technology names.

Our approach is to carefully rebalance some of those high-flying technology names and look to diversify into some of the sectors that appear relatively undervalued such as Financials and REITs. International markets started the year full of optimism, but that sentiment has since faded due to a deceleration in China’s growth prospects and global inflation remains stubborn. We retain a neutral position on global equities, with a bias towards the U.S. market.

Investment Implications

We are selectively re-balancing portfolios away from some of the large technology names that have done so well, into undervalued parts of the market like financials and REITs that are benefitting from an interest rate “pause”.

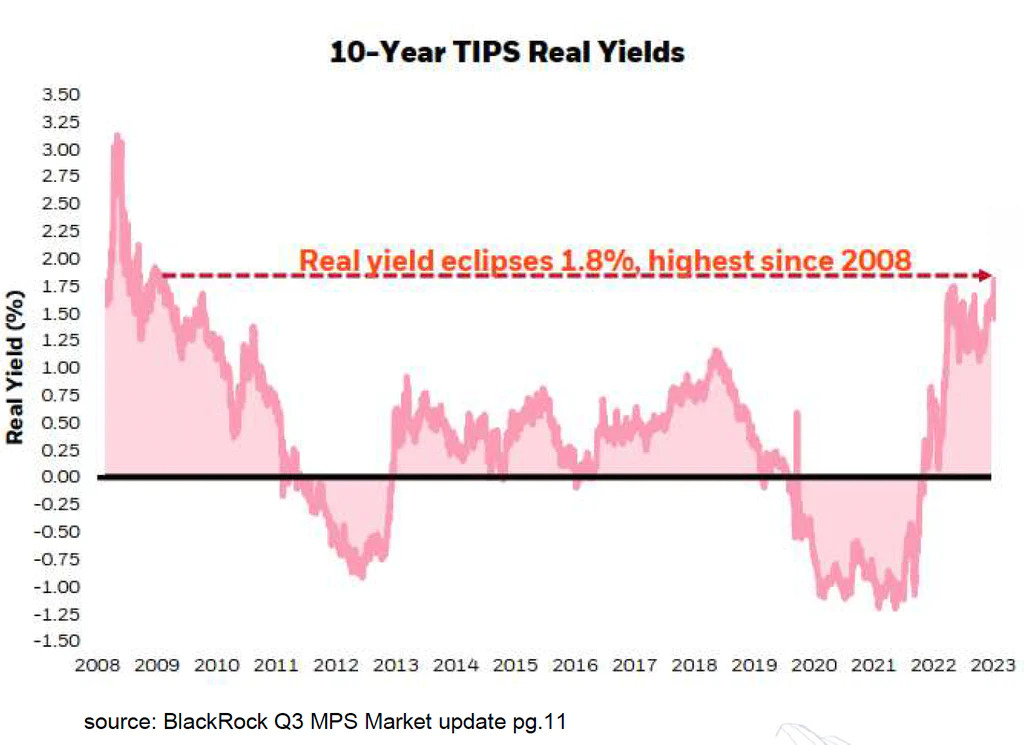

MARKET OUTLOOK – FIXED INCOME

Locking in yields, and adding duration

With regards to the bond markets, we believe that bond yields are unlikely to rise much further as inflation cools. This should allow the Fed to move towards the end of the tightening cycle. We remain confident that this is a great time to be a bond investor due to attractive current yields and the prospect that interest rates will fall over the next year which will make currently issued bonds more valuable.

Investment Implications

We prefer high quality investment grade credit ratings; however we believe it’s a good time to start buying bonds with a bit longer maturities to lock in today’s attractive yields.

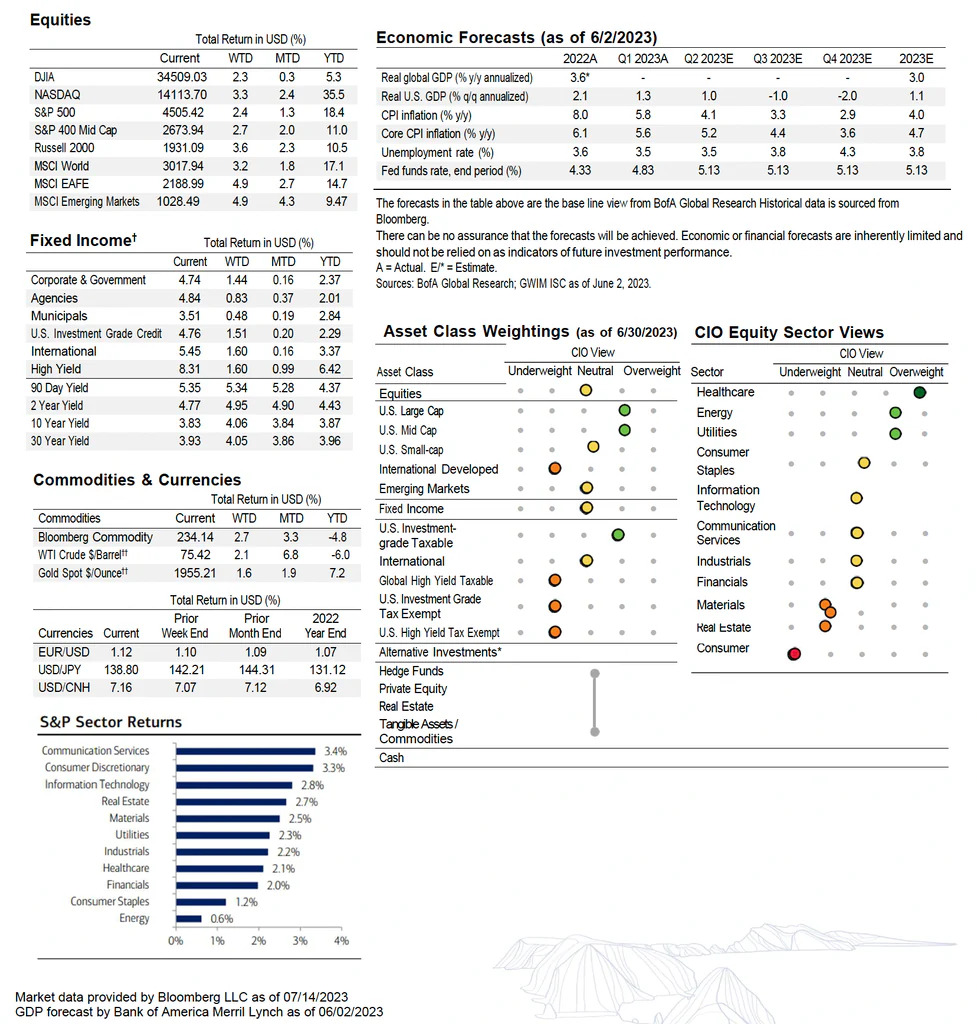

MARKETS IN REVIEW

(Market Data as of July 14, 2023)

Index Definitions

Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Chicago National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. University of Michigan’s Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan. Nasdaq is an online global marketplace for buying and trading securities. New York Stock Exchange is a stock exchange where the equity shares of public companies are bought and sold.

Important Disclosures

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Channel Wealth and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Channel Wealth or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer’s ability to make principal and interest payments. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments.

These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults Alternative investments are speculative and involve a high degree of risk. Alternative investments are intended for qualified investors only. Alternative Investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk. Non-financial assets, such as closely held businesses, real estate, fine art, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Non-financial assets are not in the best interest of all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.