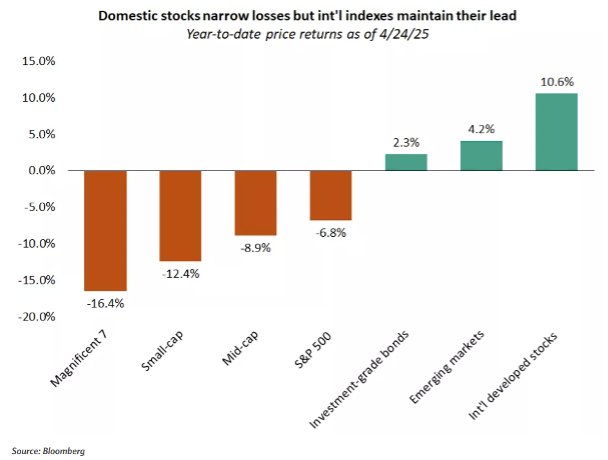

The first quarter of 2025 proved to be a volatile ride with the U.S. stock market hitting new record highs to begin the quarter, followed by sharp declines precipitated by President Trump’s tariff announcements. International markets fared much better than the U.S., and fixed income also performed well, as investors sought safety amid the heightened uncertainty in equity markets.

As we move into the second quarter of 2025, markets have staged a relief rally after moving away from extreme pessimism. The 90-day pause is a sign that the Trump administration is making an effort to de-escalate tensions. Any further gains will likely require more tangible developments on tariffs, rather than just signs of easing tensions.

In this commentary, we focus on questions that we believe are top of mind for investors.

1) What are our thoughts on tariffs and odds for a recession?

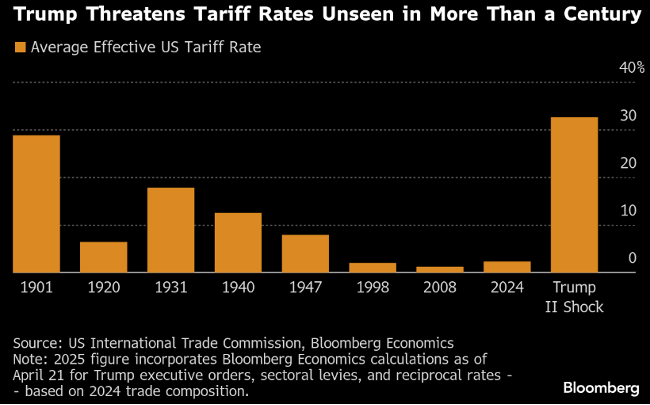

The scale of this trade shock is unprecedented. The current plan is for the average U.S. tariff rate to end up higher than the infamous Smoot-Hawley tariffs of 1930. Those tariffs in 1930 were added in addition to already high tariffs, so the actual increase from Smoot Hawley alone was only a few percentage points. Today, the average tariff rate is leaping from ~3% to 20% and trade is around 3x as big a share of the US economy than it was in 1930.

That said, it’s not the size of the policy shift, but the uncertainty around it that could cause recession. There is no clarity around what decisions out of the White House could be coming next. If you have a manufacturing plant in Mexico, and an assembly plant in the US, should you invest in Mexico? Well, not if high tariffs on Mexican imports lie ahead. Should you invest in the US? Well, not if the tariffs go away. Anything companies do right now runs the risk of stranding a substantial amount of money. As a result, in our opinion, the option to do nothing is the path of least resistance.

Looking back in history, it’s difficult to identify any historical analogue of a president-directed policy causing a recession. Radical policy changes are unusual and typically happen in response to an event. Tariffs reduce efficiency, raise the cost of living, and motivate people to buy fewer imported goods. So, while tariffs have unpleasant effects, they don’t usually lead to a collapse in demand that would cause a recession. Case in point: Britain emerged from WWII with a shortage of dollars and maintained protectionist measures throughout the 1950s, including tariffs of ~25%. These measures led Britain to being labeled the “sick man of Europe” as tariffs left the country less efficient, poorer and with slower economic growth than it otherwise would have been.

2) How are tariffs likely to impact interest rates?

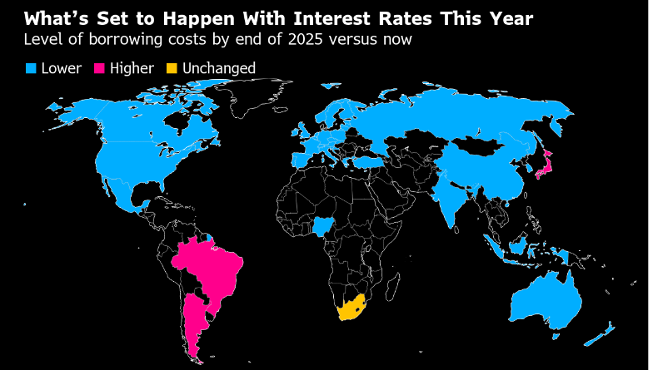

In the span of a few weeks since President Trump’s “Liberation Day,” we have seen longer term interest rates move higher. Trump’s policy shift is likely to induce not only a growth shock, but an inflation shock as well. In a recent speech, Fed Chair Jerome Powell used the word “uncertainty” 11 times. Like U.S. businesses and individuals, the Fed has been pushed into a holding pattern until there is more clarity on the impact of tariffs on the economy and the Trump administration’s overall policy course.

The bond market may not be convinced that Washington will do enough to reduce the federal deficit. For example, DOGE and Elon Musk are receiving near daily headlines for cutting spending. In actuality, DOGE has only cut 1/35 of 1% of the federal budget. On top of Congress putting together $4 trillion in potential tax cuts, we believe that bond investors are in no rush to buy bonds as concerns about mounting federal deficits, slowing growth, and inflationary policies may take hold. However, if economic slowdown occurs, we believe that the Federal Reserve may be quick to cut rates.

When rates begin to fall, historically it has been a positive for equities over the following twelve months. Interest rate sensitive industries such as housing, automotive and financials should benefit as consumers find borrowing less expensive. We believe opportunities are in dividend-paying stocks, and small capitalized stocks. Lower rates improve access to capital, and if the US avoids a recession, smaller companies may regain earnings momentum after several disappointing years.

3) What are we watching to gauge the direction of the economy from here?

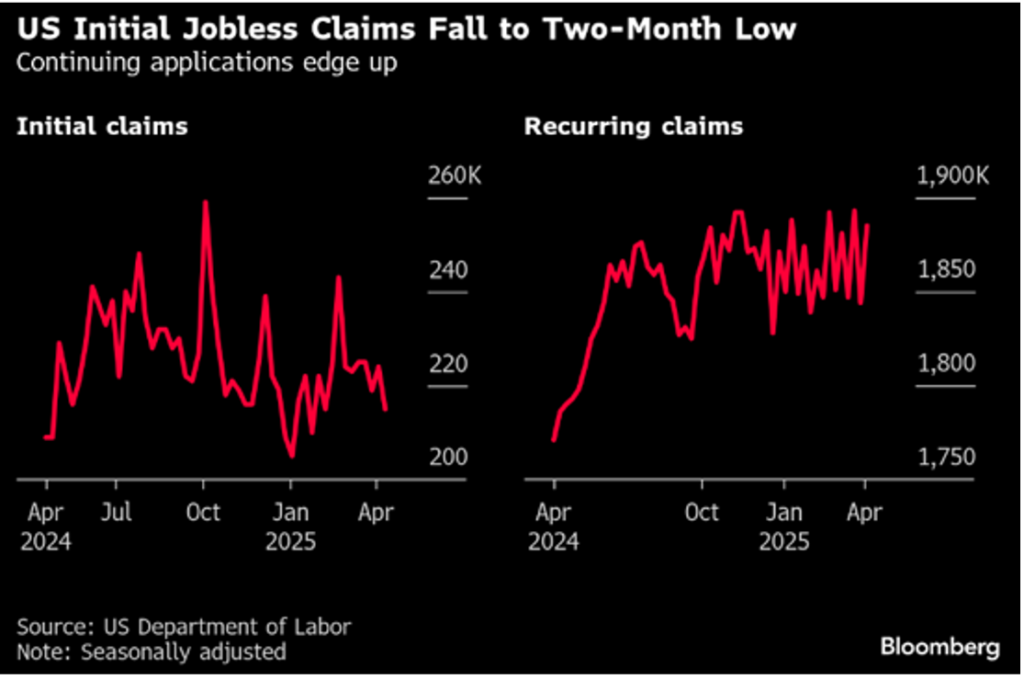

Currently the general stock market doesn’t know any more than the rest of us. We are watching indicators of market disruption including jobless claims, interest rates, and liquidity measures. Typically, it’s too much debt that acts as a catalyst for a downturn. Although debt levels in the private sector are quite manageable, there is reason to be antsy because once financial market disruptions begin, a wide variety of vulnerabilities can be exposed. It will be key to watch the data that is happening in the real economy vs. the equity and bond markets as they may remain highly volatile.

4) What is our view on the U.S. consumer?

The impact on consumer spending is a wild card. Tariffs are regressive because the bottom 80% of earners by income distribution effectively spend all their earnings, with much of their consumption on imported items. According to recent data, the US consumer and Business confidence surveys are feeling far more negative than just a few months ago. The widely tracked University of Michigan Consumer Sentiment Index surpassed the lows of the global financial crisis, while the Purchasing Manager’s Index for manufacturing sector in March shows new orders and backlogs contracting.

Conclusion:

The US economy entered the current period of policy uncertainty in an extraordinarily strong position. Households were spending a small amount of their earnings on servicing debt, as a percentage of income. That means consumers were not over-levered going into what could be a contraction. Remember that almost 70% of our economy is driven by consumer spending. As such, consumer sentiment may end up being particularly important to monitor. The current policies have eroded consumer confidence quickly, but the opposite could be true if the types of policies were adjusted to be more favorable and the roll out of policy happened according to a more telegraphed and pragmatic schedule. We continue to be cautious, with defensive positioning in accounts and will be looking at leading economic indicators that can portend more difficult conditions for the stock and bond markets.

MARKET VIEW

Joseph O’Flaherty

CIO Market Strategy

Portfolio Considerations

Given that uncertainty is quite high, broadly diversified portfolios could fare better, as international equities have maintained, and in some cases widened their lead even as U.S. stocks rebounded.

Current recession indicators are still benign. We believe the US stock market can recover it’s losses in 2025 if trade policy relaxes, and the U.S. consumer remains in healthy fiscal shape.

From a sector standpoint, we see opportunities in healthcare and financials. Healthcare offers defensive attributes but is also expected to lead the market in earnings growth in the 1st quarter.

The financial sector is less exposed to policy headwinds and may benefit from tax cuts and deregulation.

We continue to favor Investment Grade Corporate and Municipal bonds with longer maturities given their attractive prices with relatively higher yields.

Sources

- Channel Wealth Forecasts based on subjective views, and subject to change

- Bloomberg provides all our performance return data and consensus earnings estimates.

- S&P500 index for equites & Barclays Aggregate index for bonds

- Morgan Stanley: https://www.morganstanley.com/Themes/global-space-economy

- Cancer Research UK: https://news.cancerresearchuk.org/2018/02/26/millennials-top-obesity-chart-before-reaching-middle-age/

Index Definitions

Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Chicago National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. University of Michigan’s Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan. Nasdaq is an online global marketplace for buying and trading securities. New York Stock Exchange is a stock exchange where the equity shares of public companies are bought and sold.

Important Disclosures

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Channel Wealth and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Channel Wealth or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer’s ability to make principal and interest payments. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults Alternative investments are speculative and involve a high degree of risk.

Alternative investments are intended for qualified investors only. Alternative Investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.

Nonfinancial assets, such as closely held businesses, real estate, fine art, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Nonfinancial assets are not in the best interest of all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.