Executive Summary

Summer is in full swing; there’s something about this season that invites adventure, spontaneity, and a little bit of nostalgia. For investment managers, it is time to take stock of our investment themes, and to think about where the market might be taking us.

The year began with optimism, but markets were rocked by tariff shocks and geopolitical tensions, including a wave of U.S. tariffs dubbed “Liberation Day”. This triggered a 19% plunge in the S&P 500, wiping out over $10 trillion in value. However, a swift recovery followed with the index rising from the April lows and hitting an all-time high of 6204, up 6.7% for the year ending June 30th, 2025. Robust corporate earnings and solid economic data suggest that growth can remain resilient. Inflation is trending near the Federal Reserve’s 2% target.

Despite numerous crises, the economy has remained recession-resistant since the COVID-19 outbreak. That’s almost six recession-free years excluding the pandemic, the Russian invasion of Ukraine, the tightening of monetary policy, the war in the Middle East, and Trump’s Tariff Turmoil. Despite the five crises, it really has been the Roaring 2020s so far. Real GDP is at a record high and so is the stock market.

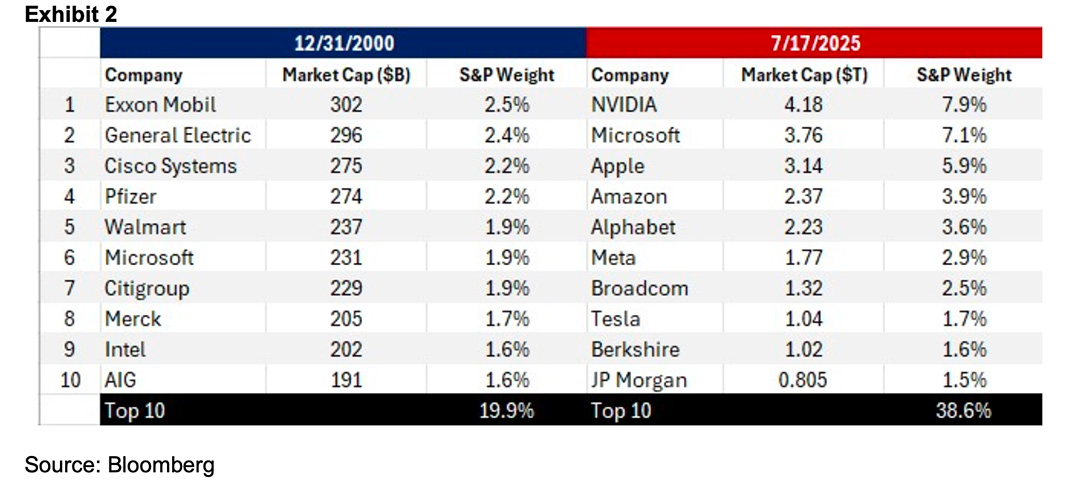

While investors may not think the economy is taking off, they are likely relieved that the worst-case scenarios feared in recent months haven’t come to pass. If corporate earnings remain resilient, the economy avoids the worst of the trade war, the Fed cuts rates this fall, and investors redeploy sidelined cash into lagging stocks, there is a strong case for further market upside as the recent narrow rally broadens. The “Magnificent Seven” tech heavyweights that have powered market gains in recent years have lost some of their luster. It will be critical to watch the upcoming earnings reports from the largest stocks—such as Nvidia, Microsoft, Apple, Amazon, Alphabet (Google), Meta, and Berkshire Hathaway—given their significant weighting in the S&P 500.

In this letter, we cover topics:

- 2025 Mid-Year Snapshot

- Potential investing opportunities and risks ahead

2025 Mid-Year Snapshot

- Global stocks overcame early second quarter losses to end the period with significant gains. U.S. bonds rallied in June and delivered a positive return for the quarter.

- Alongside a barrage of tariff announcements in early April, U.S. stocks sold off sharply. But they quickly rebounded, rallying in May and June amid a de-escalation in tariff policy and solid first-quarter earnings reports. The S&P 500 Index surged to another all-time closing high at quarter-end and posted a three-month total return of nearly 11%, and 6.70% for the first six months of the year.

- Consumer Discretionary and Healthcare have been the worst-performing sectors in the S&P 500 year to date, while Industrials and Communication Services have posted double-digit gains.

- Non-U.S. developed market stocks outperformed U.S. stocks in the first half of 2025, returning 19.3% compared to 6.2% for U.S. equities. Emerging markets also outpaced the U.S., posting a gain of 15.5% for the period.

- Many European countries are rebounding on growth optimism, political stability, and attractive valuations relative to the U.S. Increased defense and infrastructure spending, especially in Germany helped stimulate growth and supported industrial sectors.

- The Fed left interest rates unchanged at a range of 4.25% to 4.5%, awaiting more data on tariffs. The European Central Bank cut rates twice, while the Bank of England cut rates once.

- Annual U.S. headline inflation eased in April but inched back to its March level of 2.4% in May. Core inflation held steady at 2.8%. Headline inflation eased in Europe but moved higher in the U.K.

- The broad U.S. bond index posted its second consecutive quarterly gain, bringing its year-to-date return to 4%. Meanwhile, municipal bonds retained their tax-exempt status in Congress’s latest budget bill, yet are down 0.35% year-to-date.

- Bitcoin has surged above $100,000, as Trump reaffirmed his pledge to make the U.S. the “crypto capital of the planet”. 2

Potential investing opportunities and risks ahead

At the start of the year, we emphasized the importance of diversifying away from the dominant U.S. mega-cap tech stocks and exploring a broader mix of assets and geographies. That strategy has proven effective, with developed international markets gaining 19.3% year-to-date (as of June 30, 2025). A key narrative this year has been the so-called decline of American exceptionalism—a theme we do not subscribe to, as the U.S. economy remains strong across nearly every major indicator. The market cap of some of America’s leading companies is larger than the gross output of most nations. As America’s dynasty is embracing change, we continue to seek tactical opportunities to protect portfolios.

We continue to favor a balanced global allocation and are leaning into international opportunities that offer more attractive risk-adjusted returns—particularly in industries less exposed to U.S. tariffs. One example is Galderma, a Swiss-domiciled pure-play dermatological skincare company best known for its Cetaphil brand. While approximately 41% of Galderma’s revenue is derived from the U.S., we believe any potential tariff impact is likely to be modest. Cetaphil is produced in Canada and benefits from duty-free status.3 The pharmaceutical sector also enjoys significant protection, with 84% of drugs and 72% of basic pharmaceutical products exempted. 4

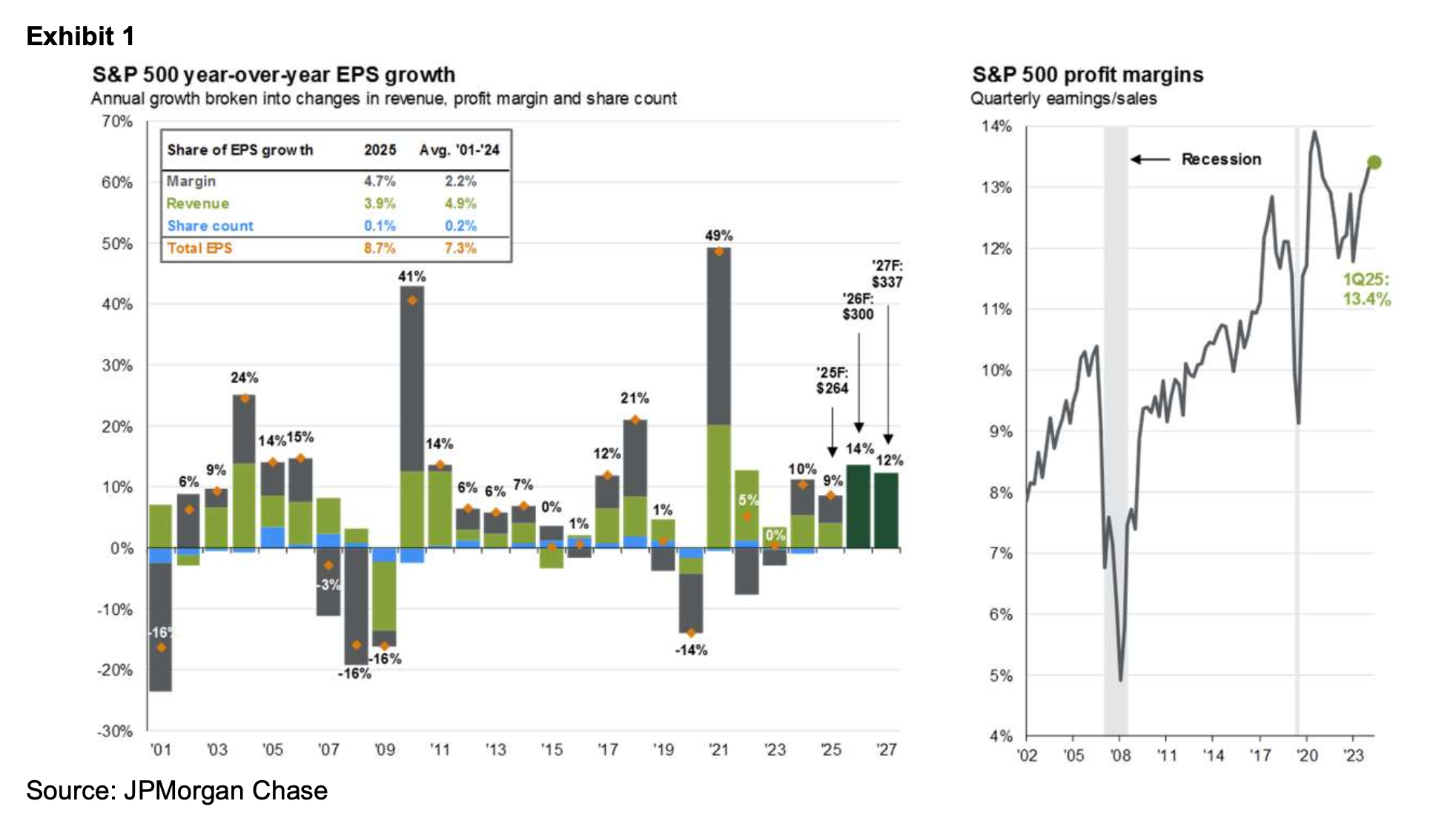

For the second half of the year, we are raising our S&P 500 forecast to (6,600), which means the S&P 500 would end up +12% for the year. The continued resilience of the economy is driven by stable corporate earnings and a Fed that will support the economy by easing rates if growth slows. We concede that our conviction is less secure in the second half, versus our first half call. The shifting tariff landscape creates large uncertainty around forecasts; the key risk will be the level of tariffs and their impact on corporate profits (Exhibit 1). Although valuations aren’t at bubble levels, concentration risk remains the primary concern. The U.S. market continues to lead global equities, both by sector and individual stocks. While dominant stock growth isn’t new, their current market concentration is unprecedented (see Exhibit 2).

Despite headwinds such as rising tariffs and geopolitical tensions, year-to-date market performance highlights the

importance of maintaining a long-term perspective and staying disciplined, focusing on economic data amid ongoing uncertainty.

Until our next meeting, we wish all our clients a happy and healthy summer season.

MARKET VIEW

Joseph O’Flaherty

CIO Market Strategy

Investment Considerations

We expect short periods of volatility in the second half of 2025 but remain bullish over the longer term as corporate earnings remain resilient. Any short-term weakness would be opportunities to rebalance.

Within Fixed Income, we find both nominal and real yields to be compelling and believe clients should continue to shift away from cash to capture longer maturity investment grade bonds.

For clients in higher income tax brackets, Municipal bonds have gone through a period of dislocation and appear attractively valued.

Lastly, alternative investments, specifically within infrastructure can provide precious diversification to a portfolio as well as attractive income.

Current recession indicators are still benign, we believe US stock market can maintain dominance, albeit there will be more volatility due to geopolitical risk and stock prices that may get ahead of themselves.

Sources

1. Bloomberg provides all market and economic data, as of 6/30/25

2. https://apnews.com/article/donald-trump-bitcoin-cryptocurrency-stockpile-6f1314f5e99bbf47cc3ee6fc6178588d

3. CW research, GALD company report

4. https://www.exportplanning.com/en/magazine/article/2025/04/07/trump-and-the-new-tariffs-of-2025-the-list-of-exempted-products/

5. JPMorgan Chase

Index Definitions

Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Chicago National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. University of Michigan’s Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan. Nasdaq is an online global marketplace for buying and trading securities. New York Stock Exchange is a stock exchange where the equity shares of public companies are bought and sold.

Important Disclosures

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Channel Wealth and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Channel Wealth or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer’s ability to make principal and interest payments. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults Alternative investments are speculative and involve a high degree of risk.

Alternative investments are intended for qualified investors only. Alternative Investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.

Nonfinancial assets, such as closely held businesses, real estate, fine art, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Nonfinancial assets are not in the best interest of all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.