Portfolio Considerations

Given that US equity markets are at all-time highs led by technology, it is time to start re-balancing to undervalued sectors like Utilities, Consumer Staples, and REITs.

Economy and Earnings Growth

The famed investor Stanley Druckenmiller once said, “that the only good economist I’ve found is the stock market”. There are a lot of pundits in the media who are negative on the economy, but we believe corporate earnings growth correlates with stock prices. Strong corporate earnings growth has driven the S&P 500 to record highs.

Fed and Inflation

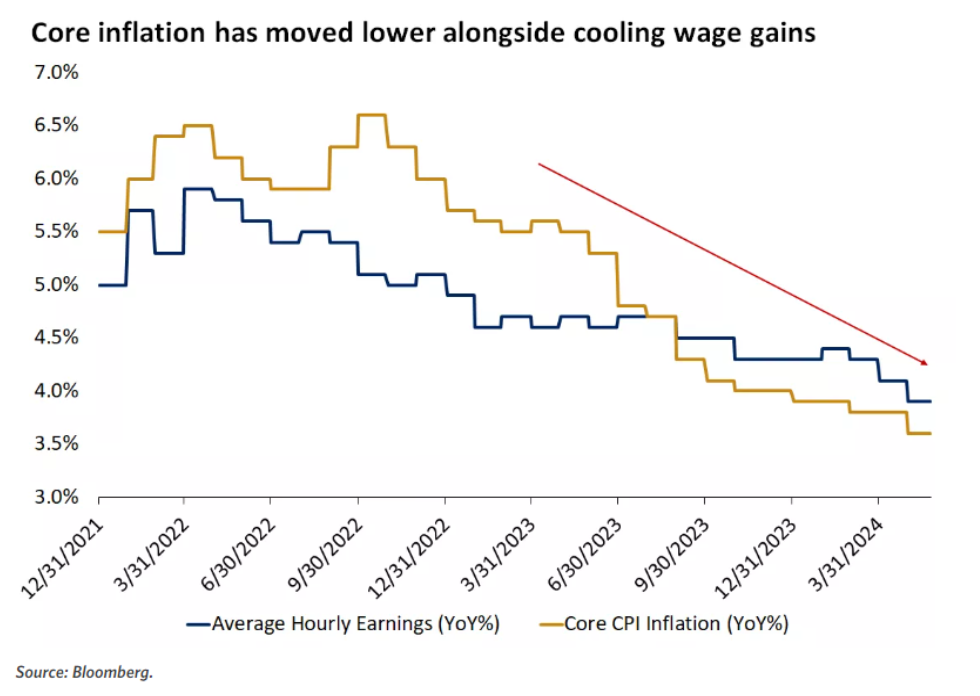

Markets have been focused on the trend in inflation and the expectations for the Fed to lower interest rates. It has been a wild year for interest rate expectations. At the beginning of the year, the expectations called for 8 rate cuts of 0.25%, or 2% lower. Only 6 months later the market is predicting a reduction of just 0.25% . That’s a big adjustment for capital markets, which use interest rates as a key component for valuing everything from stocks to real estate and much more.

AI and technology: Nvidia now & Cisco in 2000

Over the last 18 months, the S&P 500 benefited tremendously from the price performance of a small number of mega tech companies dubbed the “Magnificent 7”. Enthusiasm around artificial intelligence and extensive growth from companies like Nvidia has the potential to reshape our economy. There can be comparisons made to the 1990s during the buildout of the internet by companies like Cisco Systems. However, the main difference is that the large technology companies of today have massive cash positions on their balance sheets as a result of robust earnings compared to the money burning days of the late 1990s that led to the tech crash. Overall, we see the bull market that began in October 2022 continuing to be driven by improving inflation trends, stable economic growth, and the buildout of artificial intelligence.

Utilities have been beating technology stocks

The lion’s share of S&P 500’s performance in 2023 and first quarter of 2024 was driven by technology and growth stocks. Surprisingly, the utility sector outperformed technology and the broader market during the 2nd quarter of 2024. The utilities sector is up about 15% in the last 3 months. There’s good reason to believe the trend is just getting started.

Market-Health Dashboard

Our latest model of 17 timely indicators shows no red flags at this time. Economic signals are showing a bit more caution, however no imminent signs that bull market that began in October of 2022 is ready to stall out.

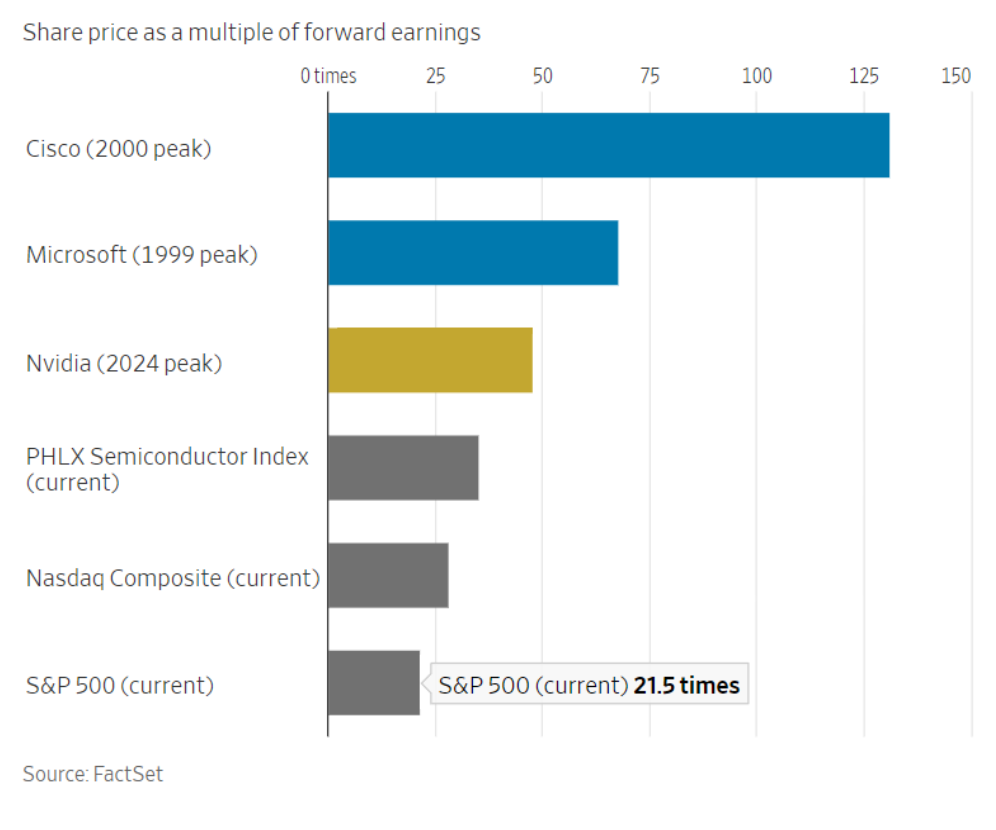

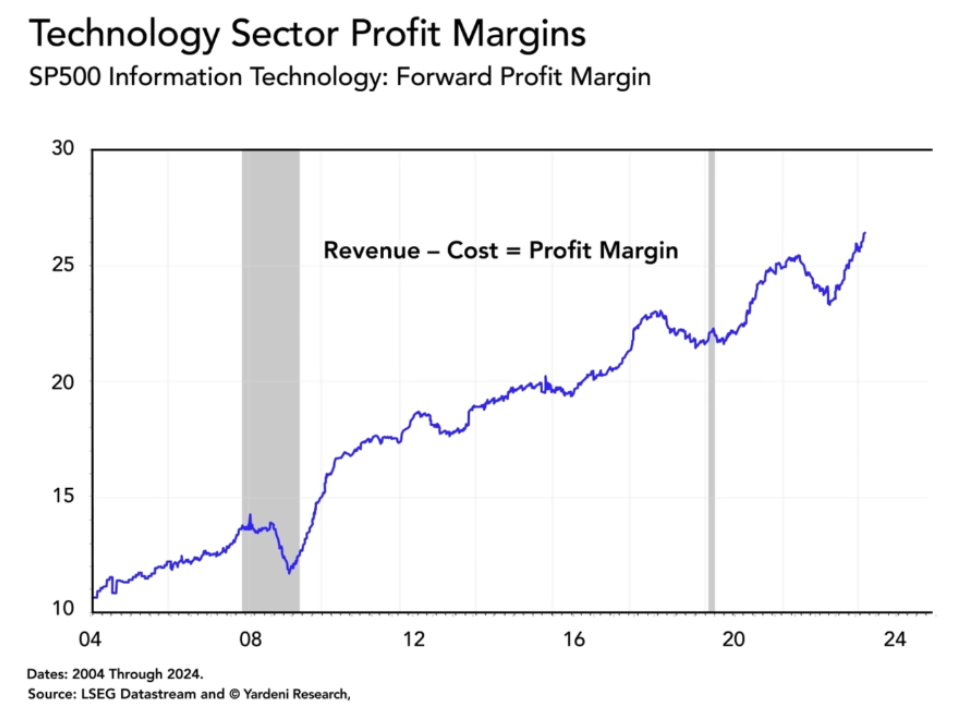

Artificial Intelligence – The difference between Nvidia now and Cisco in 2000? Valuation & Profits

The technology melt-up during the late 1990s was led by Cisco Systems which made telecommunications equipment to build out the internet. Today the melt up is led by Nvidia, which sell GPU chips used to run artificial-intelligence software. Cisco’s stock price soared to a peak of $80 from

$10 between 1998 and 2000. Nvidia’s stock price soared to a recent high of $136 from $11 between 2022 and mid-June of this year. We feel the similarities end there. Looking deeper, valuations supporting the rises show a big difference. Cisco’s forward P/E peaked around 131 on March 27, 2000. Nvidia’s forward P/E has fluctuated from between 25-80 P/E since early 2020. In addition, technology companies are 2.5x more profitable today than they were 20 years ago. Price Earnings, or P/E is a measurement of how much the market will pay for a dollar of earnings. In these examples, a P/E of 25 means the market is willing to pay $25 per $1 of corporate earnings. The higher the P/E, the more expensive a stock is compared to its earnings. High P/E ratios are warranted when the earnings component is expected to grow.

Fed and Inflation

U.S. consumer price index (CPI) readings for May came in lower than expected. That news was celebrated by the stock and bond markets alike. The overall headline CPI rate is now at 3.3% year-over-year. The data was a welcome shift and offered some affirmation that inflation does not seem to be re- accelerating. We would, however, expect the Fed to want to see at least two to three inflation readings that continue to show declining inflation before signaling a potential rate cut. Currently the market is anticipating one 25bp (0.25%) cut by end of the year.

Utilities’ Cinderella Story is just getting started

Most of the S&P 500’s performance in 2023 and first quarter of 2024 has been driven by technology and growth stocks. Surprisingly the utility sector outperformed technology and the market during the 2nd quarter of 2024. One possible reason driving utilities rally is that the electricity demand associated with artificial intelligence has woken up the long sleepy utility industry and could supercharge it well into the next decade. A.I. and cloud computing will need increased amounts of electricity to work at scale, and represent a big potential boost for power companies. According to consulting firm McKinsey, U.S electrical demand grew at 0.4% annual rate for the past decade, but is expected to jump 2.8% by 2030. Utilities are becoming an interesting way to play the growth in data centers and could represent one of the ‘second order’ effects of the A.I. boom.

Index Definitions

Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Chicago National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. University of Michigan’s Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan. Nasdaq is an online global marketplace for buying and trading securities. New York Stock Exchange is a stock exchange where the equity shares of public companies are bought and sold.

Important Disclosures

Investment advisory services offered through Channel Wealth, LLC a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Channel Wealth and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Channel Wealth or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the

U.S. or abroad. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer’s ability to make principal and interest payments. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults Alternative investments are speculative and involve a high degree of risk. Alternative investments are intended for qualified investors only. Alternative Investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.

Nonfinancial assets, such as closely held businesses, real estate, fine art, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Nonfinancial assets are not in the best interest of all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.