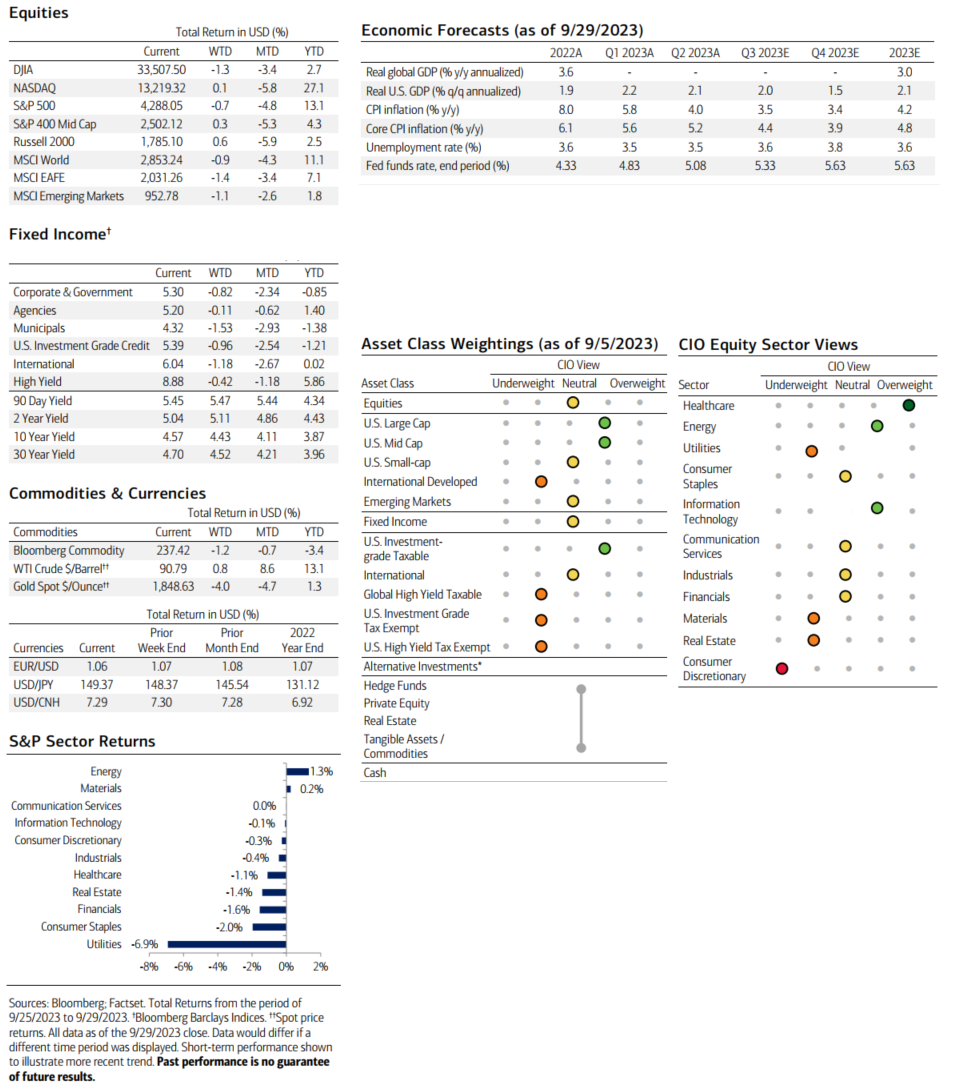

After a rally in July, the S&P 500 turned lower registering a negative return of -3.27% for Q3 but still positive on the year ending the third quarter at 13.06%1. Inflation has meaningfully slowed since the June 2022 multi decade high of 9.1%1 Any hopes of a sustained rally on cooling inflation in the third quarter were dashed as US central bank reaffirmed their commitment to making sure inflation trends towards their 2.0% target1.

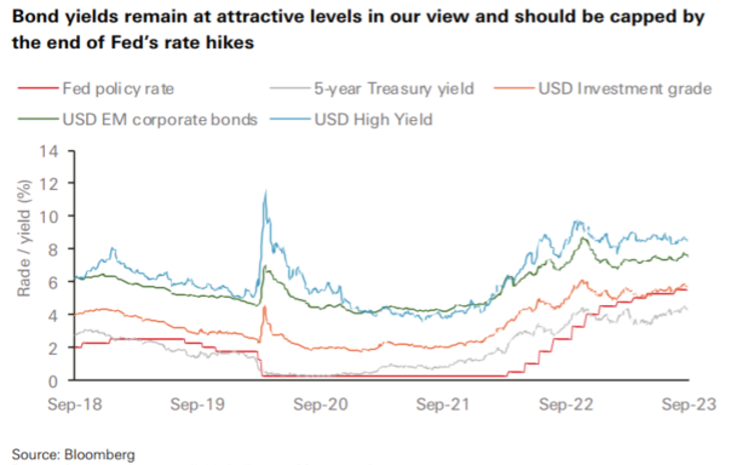

The bond market turned negative for the year at the end of September with a total return of -1.21%1. U.S. 10-year Treasury yield as of 10/4/2023 is 4.73%, the highest since 20071. Aside from stickier inflation, a few other factors behind this spike in yields has been a FED that is limiting itself as a buyer of bonds as it normalizes its balance sheet, U.S. Treasury department announced a larger than expected supply of bond sales, and Fitch Ratings downgraded US sovereign rating to AA+.

Market Outlook—Time in the market, not timing the Market.

The debate rages on whether a soft or hard landing is on the horizon. Waiting for recession has proved painful for investors expecting one. The odds of a recession happening by year end have fallen to nearly zero, compared to the start of the year economist had a 50% probability.

Defying widespread concerns of an imminent recession last October, economic resilience in the U.S. has been the key driver in stock markets advance since then. The Atlanta Fed’s GDPNow tracker, a real-time estimate of economic growth, is at 4.9% for Q32. According to Bloomberg, this year’s median earnings estimate for the S&P 500 has trended slightly lower, whereas next year’s implies growth of 10%.

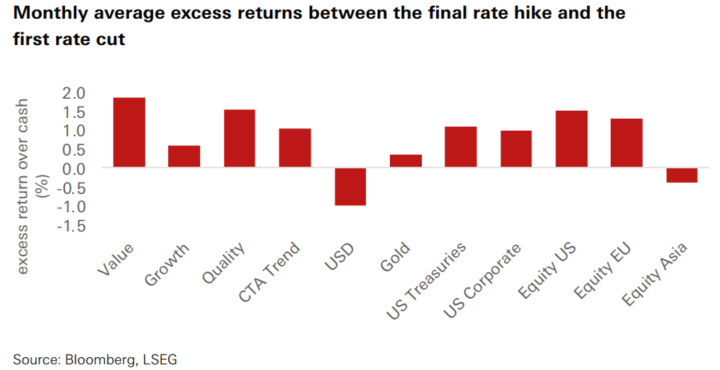

August and September resulted in negative equity and bond returns this year. Historically these months are seasonally the weakest part of the year. However there are constructive reasons for a year-end rally in markets. History teaches us that equities and corporate bonds typically do well in the 6 months after the final Fed hike, especially if a recession is avoided. Other positive reasons for optimism are corporate earnings remain durable and set to rebound for 2024, and market valuations remain favorable in certain sectors of the market and inflation is on downward trajectory.

Key investment themes

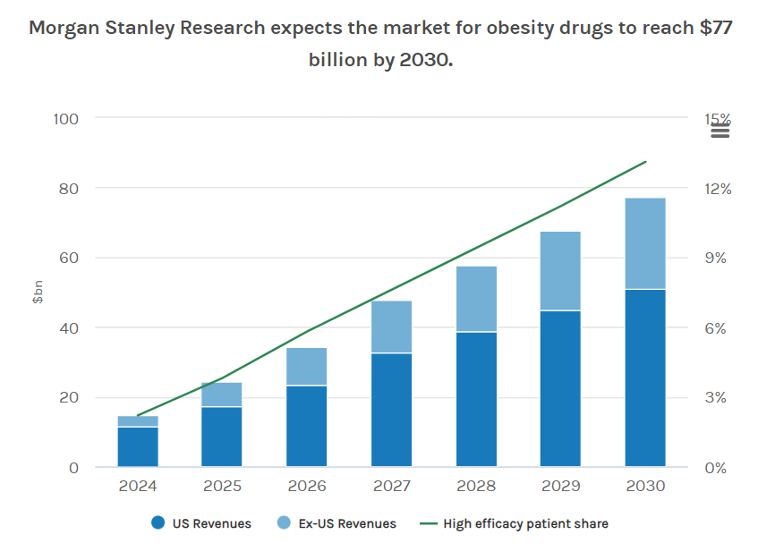

Our societies and economies are being shaped by powerful megatrends, from climate change to artificial intelligence to health and wellness. These shifts create compelling opportunities that thematic strategies can capitalize upon by investing in assets that are well positioned to benefit from the structural changes underlying the theme. One of the key themes we highlight is within lifestyle and wellness category. Diabetes may be the largest epidemic in human history. There is a class of medications developed for the treatment of diabetes, obesity, and cardiovascular disease that we believe will reshape the healthcare industry.

3rd Quarter Review—Markets recalibrating to higher rates & Crude Oil logged its best return since March 2022

Optimism in the 3rd quarter of 2023 faded as markets were left to contend with US political turmoil and surging interest rates. US stock markets and treasury bonds notched their worst quarter since September 2022. Bond market angst saw yields on the 10-year hit the highest levels since 2007 as the message from the Fed is that rates will remain higher for longer.

The S&P 500 declined -3.65% for the quarter, and is up 13.06% year to date.

Large-capitalization growth stocks, (as measured by the Russell 1000 Growth Index), have been the best performers so far in 2023, declined -3.13% for the third quarter and are up 24.97.0% for the year-to-date. Market breadth continued to be mediocre with the Russell 1000 Value Index down -3.17% for the third quarter and up 1.77%.

Small-capitalization stocks continue to lag the S&P 500, as measured by the Russell 2000 Index, declining 5.14%% in the quarter and 2.51% year to-date. 1

International equities, as measured by the MSCI ACWI-ExUS Index, declined -4.04% in the quarter but they have returned 5.02% year-to-date with Japan remaining a bright spot as its economy continues to benefit from weak yen and strong dollar, and corporate earnings rebound. The MSCI Emerging Markets Index declined 2.85% for the quarter and have gained 2.07% for the year-to-date. 1

Crude Oil logged its biggest quarterly gain since March 2022 driven by the sentiment that inventory levels in the US remain critically low while Saudi-led OPEC+ cut supply, while at the same time demand for oil is continuing to grow.

During the quarter, the 10-year U.S. Treasury yield rose significantly from 3.8% to 4.6%. This resulted in the U.S. Aggregate Bond Index declining -3.23% for the quarter and turned the index negative returning -1.21%. High-yield bonds, as measured by the ICE BofA U.S. High Yield Index, declined slightly -0.02% for the quarter, bringing the year-to-date return to 5.30%. Municipal bonds, as measured by the Bloomberg U.S. Municipal Bond Index, were down slightly for the quarter declining -3.95%, and also turned negative year-to-date returning -1.38%.1

Market Outlook

History shows us that equities and corporate bonds typically do well in the 6 months after the final Fed hike. The recent spike in Treasury yields on the back of supply concerns should not alter that conclusion, and looks exaggerated, as the end of Fed rate hikes should help anchor bond yields. We continue to put cash to work in fixed income with short term treasuries and locking in attractive bond yields.

For equity markets, we continue to favor US markets over International. The US economy is more resilient than Europe, the US should see rate cuts earlier, and it benefits more from AI innovation and the digital transformation taking place in the economy. Mega-cap technology stocks have led the race, but we think there is value looking at other areas of the market where strong US companies outside of technology offer attractive valuations and can provide diversification. We continue to overweight healthcare sector for its defensive and high-quality attributes. We also have selectively increased exposure to energy as it remains an inflation hedge. Outside of the world’s largest economy we have added some exposure to Brazil as it is an attractive entry point as we think cheap valuations and lower inflation rates should boost growth expectations.

Is the Fed’s mission accomplished?

The number one question for the economy and markets this year is whether the US Fed would be able to crush inflation without crushing the economy. Inflation has fallen to 3.7% from a high of 9.1%, with a target of 2%.1 Achieving such a soft landing would be quite a feat. It seems what most market prognosticators got wrong this year is that higher policy rates and tighter credit conditions would have a much longer lag than thought. With recession being pushed out until mid-2024 for now.

Investment Themes

Society & Lifestyle – Trends capturing innovations in therapies and diagnosis, digital healthcare, genomics and life sciences.

One of the key themes we continue to invest in are companies that have innovative solutions for diabetes, obesity, and cardiovascular disease. Diabetes may become the largest epidemic in human history1. There are 51 million people in the US that suffer from diabetes, many of the linkages of diabetes begin with obesity.4 There are now companies developing innovative and effective solutions. Both Novo Nordisk from Denmark, and Eli Lilly of the U.S. have developed a new crop of weight loss drugs, that could upend the healthcare and weight loss industry. But the implications of these treatments could reach far beyond, including food & beverage industries. Drugmakers are eager to play a role in this emerging market. Novo Nordisk’s Ozempic, likely the most well-known obesity drug is an injectable that can curb users’ appetites. Eli Lilly’s Mounjaro—approved for diabetes but used for some weight management—logged nearly $1billion in sales in its latest quarter. Morgan Stanley projects the market to be worth $77 billion by 2030.5

MARKETS IN REVIEW

(Market Data as of Sept 29, 2023)

Index Definitions

Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Chicago National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. University of Michigan’s Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan. Nasdaq is an online global marketplace for buying and trading securities. New York Stock Exchange is a stock exchange where the equity shares of public companies are bought and sold.

Important Disclosures

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Channel Wealth and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions. This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Channel Wealth or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer’s ability to make principal and interest payments. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults Alternative investments are speculative and involve a high degree of risk. Alternative investments are intended for qualified investors only. Alternative Investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk. Nonfinancial assets, such as closely held businesses, real estate, fine art, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Nonfinancial assets are not in the best interest of all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.

© 2023 Channel Wealth LLC,. All rights reserved.

Sources:

- Bloomberg

- https://www.atlantafed.org/cqer/research/gdpnow

- https://clindiabetesendo.biomedcentral.com/articles/10.1186/s40842-016-0039-3

- diabetesatlas.org

- https://www.morganstanley.com/ideas/obesity-drugs-investment-opportunity