EXECUTIVE SUMMARY

Equity markets backed up 2023 strong gains with another stellar year in 2024, underpinned by healthy economic growth in the U.S. Fixed income portfolios recorded modestly positive returns for the year, with yields falling for short maturity issues and rising for bonds of longer duration. Resilience of the U.S. economy defied widespread expectations of a slowdown, while many overseas economies struggled to gain steam. Foreign economies are expected to grow moderately while momentum in the U.S. is likely to endure, driving another year of healthy corporate profit growth.

THE OUTLOOK FOR 2025 – GLASS STILL HALF FULL

We are living in extraordinary times, where perspectives on the world vary dramatically. On the positive side, we are witnessing incredible technological discoveries, advancement in healthcare, rising GDP per capita in many countries, and soaring asset prices boosting individuals net worth. At the same time, a contrasting narrative emerges, especially those impacted by inflation or military conflicts. Governments across the globe are grappling with ballooning deficits. Many countries face complex demographic shifts with aging populations and low birth rates as well as political discontent with the ‘establishment.’ Yet, despite all these cross currents, our investment outlook for 2025 still tilts positive. We see economic momentum continuing, accommodative financial conditions and strong nominal earnings growth that gives us confidence that not only is the cycle not over, but more gains for investors could lie ahead in 2025. Equally as important, we still see several mega investment themes that we believe will continue to act as a tail wind for investors.

Mega Themes with investable tailwinds:

- Space Economy > worth 1 trillion by 20404.

- Obesity > Millennials are the most “obese” generation ever5.

- Easing financial conditions > lean into cyclical “economically sensitive” stocks.

- Rotation out of “risk-free” cash. Investors moving cash out of Treasury bills into longer duration assets.

MARKET VIEW

Joseph O’Flaherty

CIO Market Strategy

Portfolio Considerations

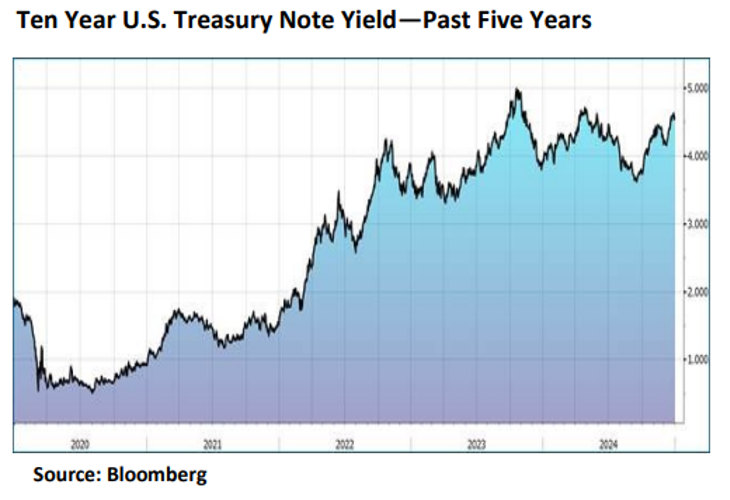

We maintain our tactical Equity overweight in the U.S. relative to the rest of the world given a broad based and continuous earnings recovery, resilient consumer, and a solid growth outlook. Our highest conviction remains within Fixed Income, that the yield curve will normalize as short-term rates move lower. With that in mind, investors should consider moving out of investable cash, and into longer term fixed income instruments to lock in current attractive yields.

ECONOMY

While we remain optimistic about global economic growth in 2025, we believe that the Fed’s path of rates is highly uncertain. We expect more inflationary pressures and market volatility under President Trump. A few themes that we will be monitoring: 1) Energy Transition— we think there will be a decrease in federal funding for renewable energy. The longer the energy transition takes, the more expensive it will be. 2) Shift from “Benign Globalization” to “Great Power Competition”. There is potential for a 10% tariff on all US imports, 60% tariff on Chinese exports. We would expect onshoring of US businesses to continue, which could be inflationary in the near term. 3) The Great Labor Rebalance—with more constraints on immigration, we would expect labor shortages to continue, which puts upward pressure on wage inflation. Potential risks on the horizon include geopolitical escalation and tariffs that are too effective which could hurt GDP growth. One outlier we need to monitor is how effective Elon Musk’s DOGE will be in cutting US spending.

EQUITIES

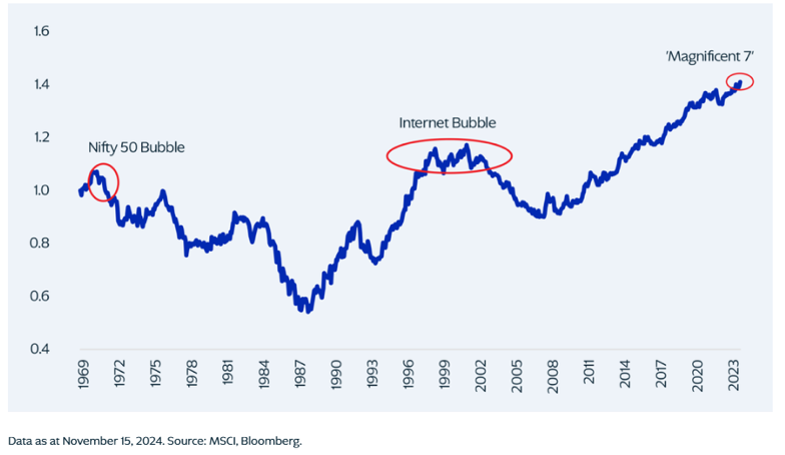

U.S. equity indices registered stellar gains for 2024, with the S&P 500 Index up by 25% for the year propelled by a narrow group of large technology stocks, leaving stable stocks out of favor2. The returns for other major equity benchmarks spanned a wide range, with the Dow Jones Industrial average up 15%, the equal weighted S&P 500 Index gaining 13%, U.S. small capitalization stocks increasing 12%, and international stocks as measured by the EAFE Index up only 4%2. Corporate profit growth of more than 10% and expectations of interest rate cuts by the Fed underpinned gains in stocks2.

The US market believes that it has the macro picture figured out as it has priced in a pro-growth with benign risk forecast for 2025. Our base case is for resilient growth in the first half of 2025, and a weaker second half of the year as visibility weakens. Our thesis rests on that there are two “puts” in place, a Federal Reserve that is easing financial conditions and President that is pro-growth. We believe we are in the later parts of this cycle; we want to position portfolios for cyclical tilt, but we do not want to abandon the big cash producers of the “Mag 7”.

Relative Performance of U.S. Equities vs. Global Equities

FIXED INCOME

Bond yields have surged in the last part of 2024, we believe it is a great time to rebalance portfolios from the pricey stock market and reinvest in bonds where we can lock in these higher yields. We would not be surprised if the bond market outperforms the stock market in 2025. Areas we favor are investment grade corporates with medium duration, and municipal bonds.

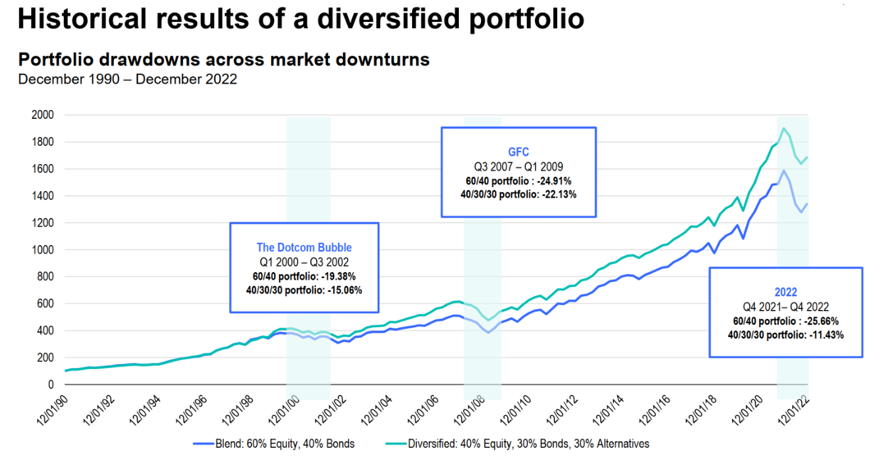

ALTERNATIVES

President Trump’s victory has pushed us to double down on our conviction of increased inflation volatility. Regardless of the path of U.S. rates, elevated inflation volatility is driving a higher correlation between stocks and bonds, compelling investors to find diversification elsewhere. We believe this period will be an opportune time to adjust portfolio construction and lean into private markets. Over the past 10 years, 60% stock / 40% bond portfolio returned an average of ~8%3. To achieve that return over the next five years amid elevated inflation, higher borrowing costs, and slower real economic growth, investors may need to diversify into alternative asset classes such as private credit, private equity, and infrastructure. The advantage of rebalancing with a tilt towards alternatives is to increase returns, generate income, and reduce volatility.

Sources

- Channel Wealth Forecasts based on subjective views, and subject to change

- Bloomberg provides all our performance return data and consensus earnings estimates.

- S&P500 index for equites & Barclays Aggregate index for bonds

- Morgan Stanley: https://www.morganstanley.com/Themes/global-space-economy

- Cancer Research UK: https://news.cancerresearchuk.org/2018/02/26/millennials-top-obesity-chart-before-reaching-middle-age/

Index Definitions

Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Chicago National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. University of Michigan’s Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan. Nasdaq is an online global marketplace for buying and trading securities. New York Stock Exchange is a stock exchange where the equity shares of public companies are bought and sold.

Important Disclosures

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Channel Wealth and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Channel Wealth or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer’s ability to make principal and interest payments. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults Alternative investments are speculative and involve a high degree of risk.

Alternative investments are intended for qualified investors only. Alternative Investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.

Nonfinancial assets, such as closely held businesses, real estate, fine art, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Nonfinancial assets are not in the best interest of all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.