Dear Investors,

We are pleased to welcome you to the new year and present our 2026 Market Outlook Report.

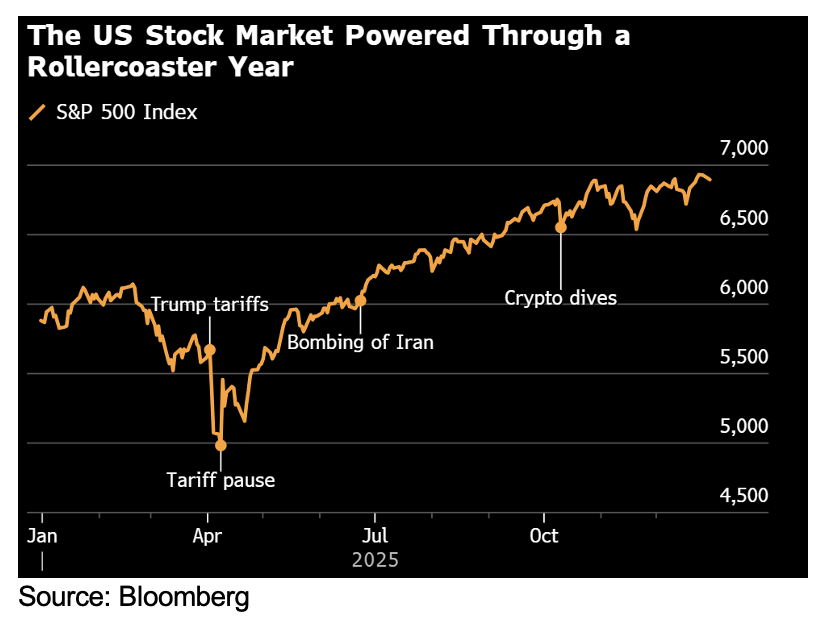

Closing out 2025, global stock markets delivered a spectacular performance. Despite initial volatility surrounding President Trump’s “Liberation Day” tariffs, the U.S. market rose like a phoenix, powered by robust corporate earnings. The S&P 500 gained 17.9% in 2025, marking its third consecutive year of double-digit gains1.

The “Magnificent 7” continued to provide a sturdy floor—rising 24.9%—the most notable trend of 2025 was the broadening of the rally. The remaining 493 companies in the S&P 500 returned a healthy 15.6%, signaling widespread market strength.

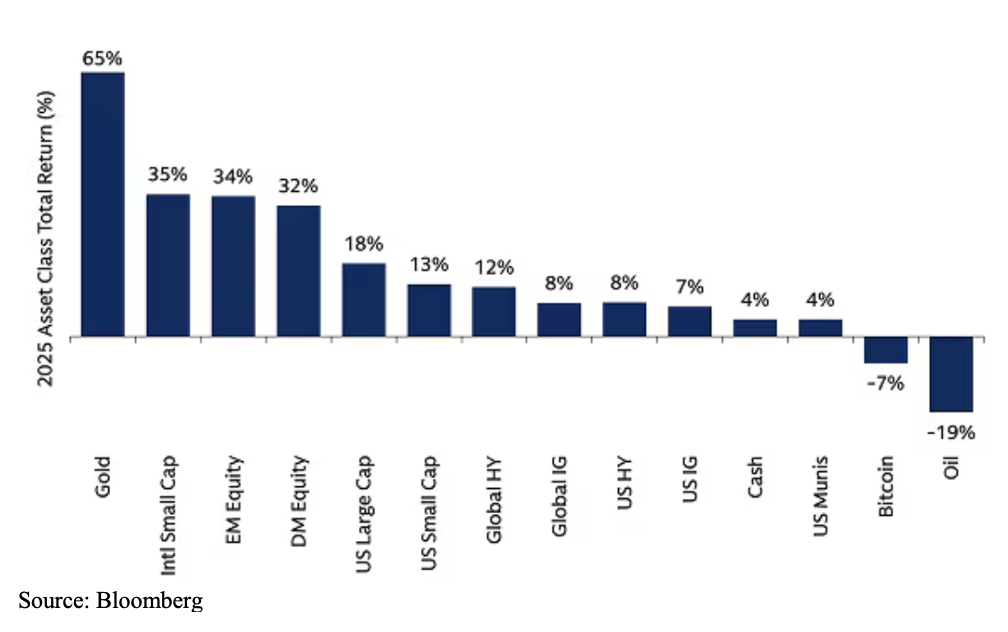

Gains were not confined to the United States. International markets rose 22% and precious metals recorded one of their best years in decades amid a rush to safe havens. Copper and rare earths were also standout performers, highlighting their geopolitical importance. Before a recent consolidation, cryptocurrencies were on track to beat equity returns for the year. Conversely, the major laggards for 2025 were oil and the U.S. dollar; oil headed for its deepest annual loss since 2020 due to oversupply concerns.

While there are certainly reasons for caution—growing national debt, inflation risks, and debates over AI stock valuation—we believe these are challenges for another year. In this letter, we recap 2025 and outline the opportunities we find attractive for 2026.

2025 Market Recap & Outlook: Turning Lemons into Lemonade

Earlier this year, the market was dealt a difficult hand. Between new tariff schedules, lousy consumer sentiment, a hawkish Fed, poor housing affordability, and a slowing economy, there were ample reasons for concern. However, Corporate America did what it does best: it adapted. After a shaky April, the Tech sector led a massive turnaround, setting a positive tone that eventually spread across the entire S&P 500 and international markets.

The results have been impressive. Not only did annual corporate profits surprise to the upside—rising 13% in the third quarter of 2025—but the economy also grew at a 4.3% annualized rate through October1. This is an astonishing feat considering we navigated a record-breaking government shutdown and growing skepticism regarding the strength of the AI rally.

MARKET VIEW

Joseph O’Flaherty

CIO Market Strategy

Investment Considerations

As we look toward 2026, our base case is another positive year. With recession odds remaining low, double-digit earnings growth likely, and tailwind of favorable government policies. We think better earnings breadth should make a case for diversifying outside of the “Mag 7” and investing globally and in more cyclical parts of the US economy.

Within fixed income, we lean towards holding slightly longer maturities while focusing on high quality credit given the tight credit spreads to treasuries.

We continue to allocate towards the alternative asset classes which offer diversification away from concentrated tech names in public markets, and exposure to attractive yields in private credit and infrastructure.

International economies have weathered the global trade war surprisingly well in our view. International developed index returned more than 33.2%3, while emerging markets delivered a 34.3%4 return in 2025. The past year marked the end of a 15-year stretch in which foreign markets lagged behind the U.S1. The drivers for this outperformance included attractive valuations, the adoption of artificial intelligence, electrification themes, and improving financial conditions globally.

Equity Outlook for US & International Markets: We maintain our overweight on US equities as the market remains upbeat on 2026 corporate earnings momentum. One of the biggest and most surprising factors driving earnings is margin strength. Despite the uncertainties such as tariffs, large-cap

companies have been able to expand margins—a testament to both their agility and efficiency gains from innovation, including AI. Forecasts suggest profits will climb by another 15%1.

We believe overall market breadth should improve thanks to fiscal stimulus and some cyclical acceleration in traditional industries.

Outside the US, Japan and India have outpaced the U.S. earnings growth. Japan, and India markets have been driven by structural reforms and government spending in Europe. The global backdrop of lower US rates, and a weaker US dollar is supportive for international investing.

Positive Earnings Revisions in most regions

What does history say?

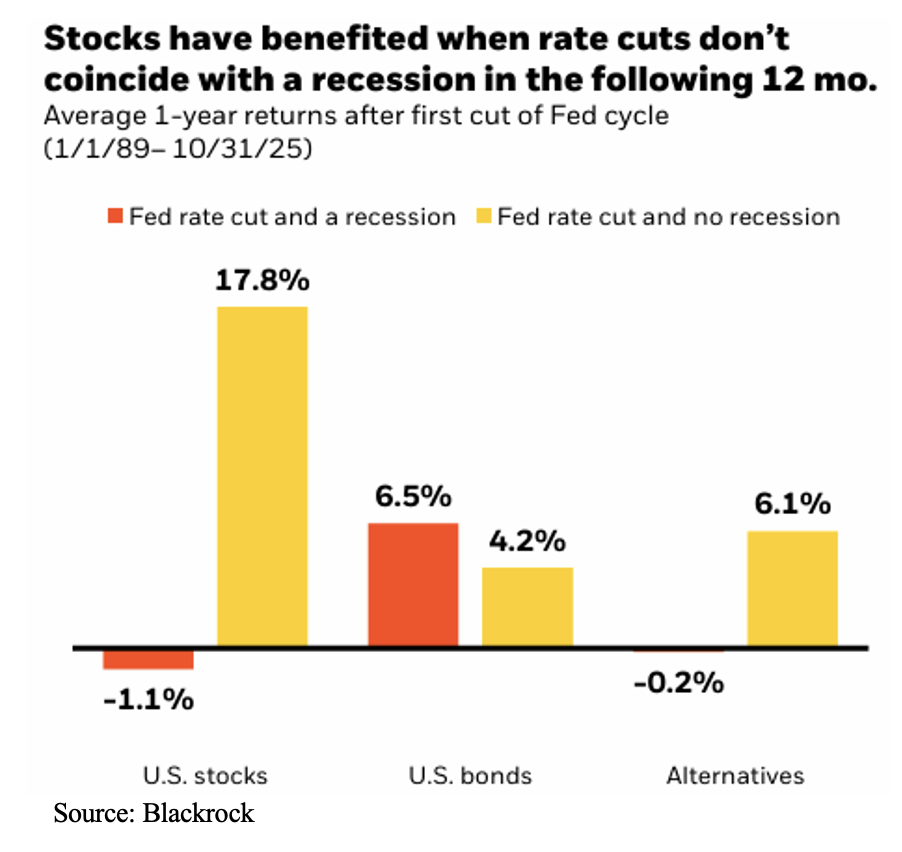

The combination of the 2nd year of a presidential cycle (the “Midterm Year”) and Federal Reserve rate cuts create an often-volatile environment for stock market. Historically, the 2nd year is the weakest of the four-year presidential cycle.

Conversely, when the Fed rate cuts to prevent an economic slowdown, (absent a recession) there are often above average returns the following year in the market. We see the first half of the year being more problematic for equity markets until midterm electionuncertainty clears. The second half of the year, we believe the market will likely generate most of its gains as rate cuts work their way into the economy.

Fixed Income:

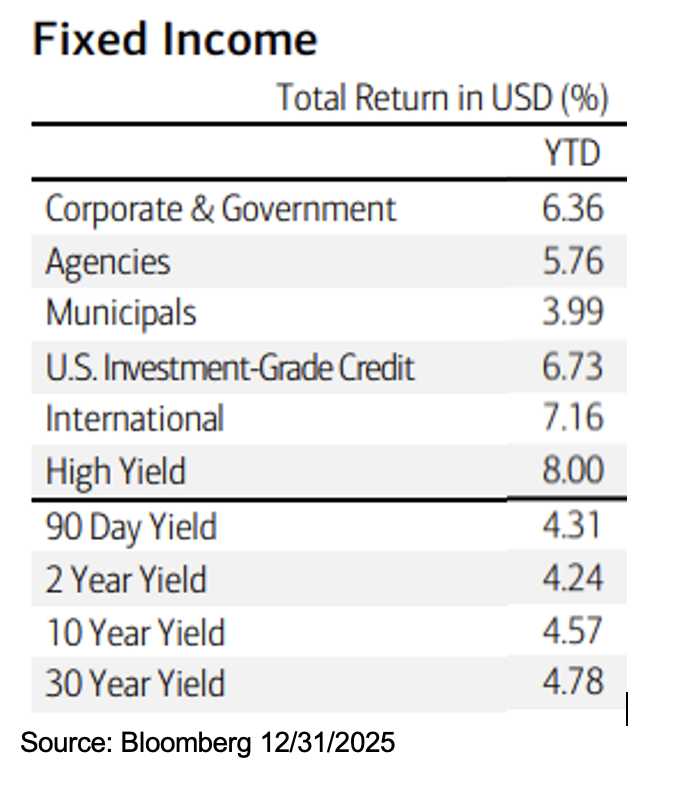

The Treasury market in 2025 delivered its best total return since 2020 as the Federal Reserve cut interest rates in response to weakening labor market conditions. Taxable bonds rallied aggressively earlier in the year as the economy cooled and the Fed signaled cuts. The municipal bond market did not participate in this early rally as it faced a “perfect storm” of technical and fundamental headwinds that caused it to significantly lag behind taxable counterparts like U.S. Treasuries and corporate bonds. While the Municipal bond asset class managed a rally late in the year to salvage positive absolute returns, the relative underperformance was driven by three primary factors: a historic surge in supply, legislative anxiety, and rich starting valuations.

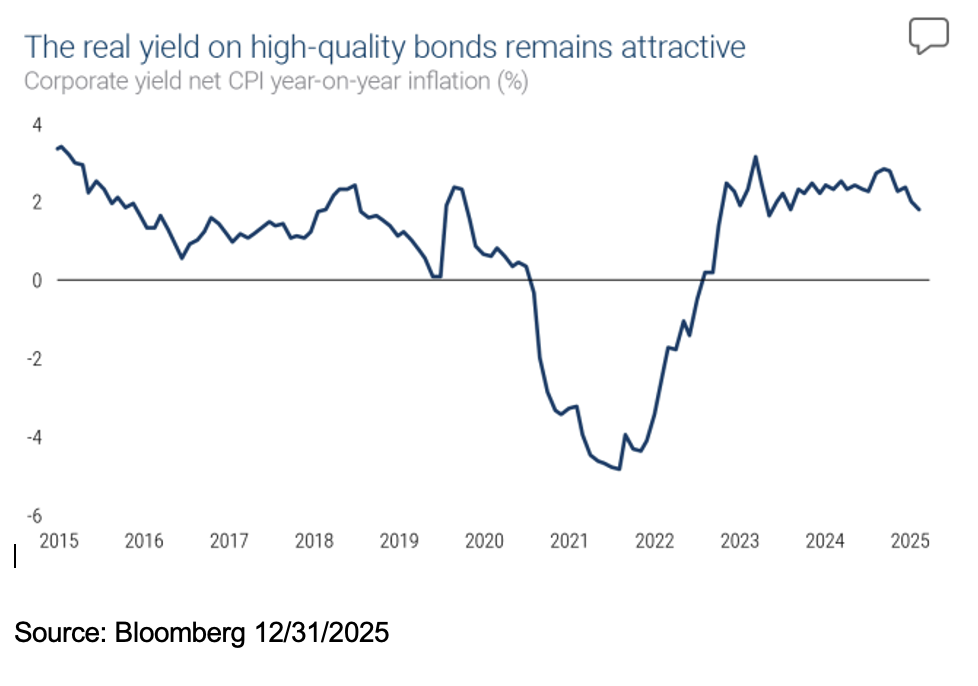

Fixed Income Outlook for 2026: We believe prospects for bonds continue to look strong. With proactive rate cuts by the Federal Reserve, resilient corporate fundamentals, and continued investor appetite for fixed income, conditions support compelling returns. Investment grade bond fundamentals appear solid, but credit spreads are relatively tight to treasuries.

We see 2026 shaping up to be a year where investors should be able to find value by extending duration and focusing on high quality global diversification. With 10-year Treasury yields around 4% and investment-grade credit yielding near 5%, investors can generate solid real income, especially with inflation hovering around 3%.

Commodities

Oil prices slid further during the 4th quarter, falling to a four-month low amid ongoing concerns about oversupply. Gold shattered expectations breaking through $4,000/oz barrier late in the year. While copper prices surged to all-time highs $12,000/ton driven by the data center and electrification A.I. buildout. Oil prices remained soft, averaging in the mid-$60s, driven by Non-OPEC supply flooding the market, while demand from China continued to soften to their high EV adoption rates. Given the massive infrastructure needs, we see industrial metals like copper with the highest upside in 2026.

Economic Summary – What you need to know

Economic resilience has been a key theme in 2025, and we think the setup for 2026 continues to be positive.

Several tailwinds support our optimistic outlook:

Businesses to immediately deduct capital expenses (R&D, equipment): The “One Big Beautiful Bill,” effective January 1, 2026, allows businesses to immediately deduct capital expenses (R&D, equipment). CBO analysis indicates this legislative change could lift GDP by nearly 0.9%2.

Corporate Profitability: After rising 13% in Q3 2025, corporate profits are forecast to climb another 15% in 2026. Globally, profits are set to rise 6-11%.

Monetary & Consumer Support: We anticipate lower interest rates, consumer tax refunds, and a weaker U.S. dollar to act as economic lubricants

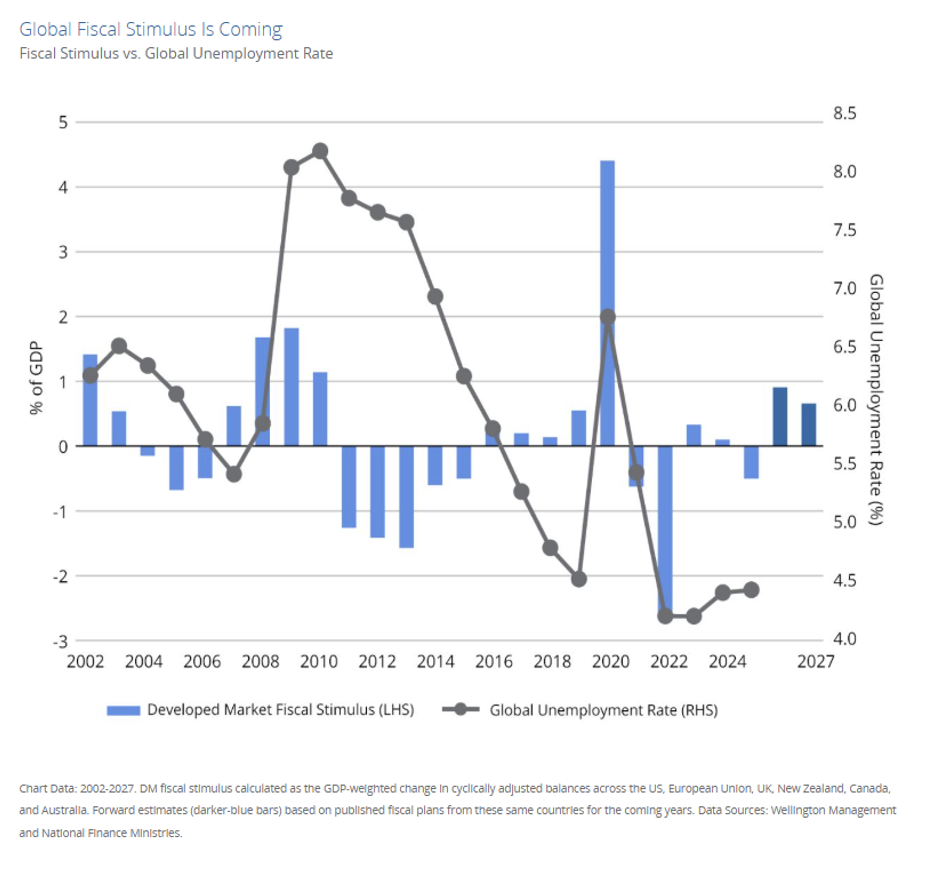

Global Fiscal Stimulus:

Every developed market region has planned fiscal stimulus that should support economic growth. This liquidity should drive business activity and economic growth.

In summary: We are optimistic heading into 2026. This positive stance is supported by four key pillars: the ongoing AI revolution, continued easing from the Fed, proactive fiscal stimulus, and a labor market that we expect to stabilize and begin a modest rebound.

Ultimately, successful investing in this cycle is about separating structural signals from market noise. As always, if you have questions about how these global shifts impact your specific situation, please do not hesitate to reach out. Thank you for your continued partnership.

Sources

- Bloomberg provides all market and economic data, as of 12/31/2025

- https://www.cbo.gov/system/files/2025-06/hr0001-dynamic-estimate.pdf, H.R. 1, One Big Beautiful Bill Act

- International Development Markets benchmarked using MSCI ACWI-EX USA

- Emerging Market benchmarked using MSCI Emerging Market Index

Index Definitions

Securities indexes assume reinvestment of all distributions and interest payments. Indexes are unmanaged and do not take into account fees or expenses. It is not possible to invest directly in an index. Indexes are all based in U.S. dollars. S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Chicago National Activity Index is a monthly index designed to gauge overall economic activity and related inflationary pressure. University of Michigan’s Consumer Sentiment Index is a consumer confidence index published monthly by the University of Michigan. Nasdaq is an online global marketplace for buying and trading securities. New York Stock Exchange is a stock exchange where the equity shares of public companies are bought and sold.

Important Disclosures

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Channel Wealth and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Channel Wealth or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa. Bonds are subject to interest rate, inflation and credit risks. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer’s ability to make principal and interest payments. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults Alternative investments are speculative and involve a high degree of risk.

Alternative investments are intended for qualified investors only. Alternative Investments such as derivatives, hedge funds, private equity funds, and funds of funds can result in higher return potential but also higher loss potential. Changes in economic conditions or other circumstances may adversely affect your investments. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.

Nonfinancial assets, such as closely held businesses, real estate, fine art, oil, gas and mineral properties, and timber, farm and ranch land, are complex in nature and involve risks including total loss of value. Special risk considerations include natural events (for example, earthquakes or fires), complex tax considerations, and lack of liquidity. Nonfinancial assets are not in the best interest of all investors. Always consult with your independent attorney, tax advisor, investment manager, and insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy.

|

© 2026 Channel Wealth LLC. All rights reserved.